- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

electrode powder price factory

The Dynamics of Electrode Powder Pricing in Manufacturing

Navigating the world of electrode powder requires a nuanced understanding of the market dynamics, especially when trying to gauge the price fluctuations at the factory level. Having spent years in this field, I've witnessed firsthand the challenges faced by manufacturers like Hebei Yaofa Carbon Co., Ltd. You might think it's all about the market rates, but there's much more beneath the surface.

Understanding the Cost Factors

Surprisingly, the cost of electrode powder isn't just about raw materials. Sure, the prices of graphite or carbon are foundational, yet logistical considerations often rival these costs. For instance, transport disruptions can rattle supply chains, pushing prices unpredictably.

Take Hebei Yaofa Carbon Co., Ltd. (visit: their website). They have over two decades of experience, which allows them to anticipate and mitigate some of these upheavals. But even seasoned players sometimes find themselves on unpredictable terrain.

Quality control is also a significant expenditure. Factories balancing tight budgets often struggle to maintain rigorous testing standards, further influencing the overall pricing structure.

Market Demand and Seasonal Trends

Demand, of course, plays a crucial role. Yet, it's not just about how much industry needs at any given time. There's a seasonality aspect that isn't often discussed. For instance, peak manufacturing seasons can see costs soar, driven more by demand than actual material scarcity.

Hebei Yaofa has developed strategies to handle these fluctuations, capitalizing on slower periods to stockpile and prepare. This experience-driven approach often helps in maintaining competitive pricing when others might falter.

However, predicting these demand spikes requires a nuanced understanding of both global and local market trends, something that can only be honed with experience.

The Impact of Technology and Innovation

Another angle often overlooked is technological advancement. Innovations in production techniques can significantly affect costs. An upgraded processing line might reduce waste, but the upgrade itself incurs upfront costs, something to weigh carefully.

In companies like Hebei Yaofa, investments in technology are often long-term considerations. The reduction in material wastage and improvements in efficiency can lower prices over time, but initial costs must be justified by a stable market outlook.

Thus, tech investments become a dance of timing and market readiness. Jumping too early or too late can have financial repercussions.

Regional and Global Economic Factors

Global economics can also lead to unexpected changes in electrode powder prices. Tariff changes, political upheavals, and currency fluctuations often have ripple effects that disrupt planning.

In regions where Hebei Yaofa operates, political stability and trade policies are closely monitored. Understanding regional economic signals allows them to anticipate changes and hedge against potential risks.

Yet, these measures aren't foolproof. There are times when rapid political shifts catch even the best-prepared off guard, leading to reactive pricing strategies rather than proactive ones.

Conclusion: The Human Element in Pricing Strategies

At the end of the day, what really shapes the pricing is not just numbers or market factors—it’s the people behind the production lines. The decisions made in boardrooms or on factory floors, based on decades of experience, such as those by Hebei Yaofa Carbon Co., Ltd., define how well a company can adapt to ever-changing conditions.

This human element makes the pricing of electrode powder as much an art as it is a science. The intuition and adeptness of seasoned professionals shape market stability in ways that algorithms cannot replicate.

In sum, the price you see is a culmination of countless decisions, adjustments, and strategies honed over years of understanding both the tangible and intangible elements of the business. It’s this synthesis of knowledge and experience that truly dictates the cost of electrode powder at the factory level.

Related products

Related products

Best selling products

Best selling products-

High-power graphite electrodes, 600 mm diameter, for export.

High-power graphite electrodes, 600 mm diameter, for export. -

Granular carburizer

Granular carburizer -

RP normal power graphite electrode

RP normal power graphite electrode -

HP high power graphite electrode

HP high power graphite electrode -

Spherical carburizer

Spherical carburizer -

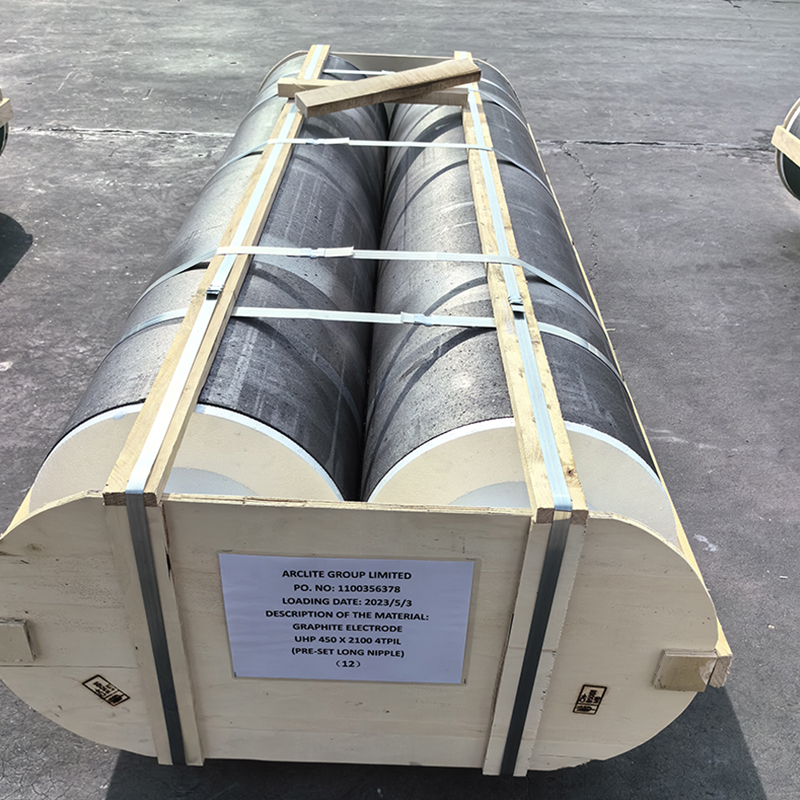

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces.

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces. -

High-power graphite electrode rods, specifically for steelmaking and refining. In stock and ready for immediate shipment. Bulk orders receive discounted pricing.

High-power graphite electrode rods, specifically for steelmaking and refining. In stock and ready for immediate shipment. Bulk orders receive discounted pricing. -

Columnar carburizer

Columnar carburizer -

High-temperature resistant silicon carbide crucible, specially designed for melting aluminum and copper, corrosion-resistant and impact-resistant, direct from the manufacturer.

High-temperature resistant silicon carbide crucible, specially designed for melting aluminum and copper, corrosion-resistant and impact-resistant, direct from the manufacturer. -

960 Graphite Electrodes – High Power, Ultra-High Power – Worldwide Shipping

960 Graphite Electrodes – High Power, Ultra-High Power – Worldwide Shipping -

UHP ultra high power graphite electrode

UHP ultra high power graphite electrode -

High-power graphite electrode anti-oxidation coating: high temperature resistance, wear protection, and extended electrode lifespan.

High-power graphite electrode anti-oxidation coating: high temperature resistance, wear protection, and extended electrode lifespan.