- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

graphite crucible price

Understanding the Dynamics of Graphite Crucible Prices

The cost of graphite crucibles is a common concern for manufacturers and buyers alike. Prices fluctuate based on several factors—but one constant is the critical role these crucibles play in high-temperature material processing. Interestingly, despite their importance, there's a lot of misunderstanding surrounding their pricing structures.

Supply and Demand Influences

At the heart of any price consideration is the classic supply and demand curve. With graphite crucibles, for instance, the demand raises sharply during periods of high industrial activity. Think of sectors like foundries or advanced material manufacturing. The catch, though, is the supply chain. Even minor disruptions can affect availability.

Fairly recently, heavy rains in certain graphite-producing regions impacted mining operations, leading to supply shortages. I've seen firsthand how this kind of disruption sends prices soaring—buyers scramble to secure inventory, while manufacturers, like Hebei Yaofa Carbon Co., Ltd., which you can find more about at their website, adjust their outputs accordingly.

it's not just raw material availability—transportation issues also complicate matters. If a crucial shipment gets delayed, the cascading effect on prices is almost immediate.

Material Quality and Production Techniques

The quality of the graphite itself is another major determinant of cost. Standard vs. high-purity graphite can make a significant difference. A friend of mine, who once spearheaded procurement for a steel plant, used to stress over this. Choosing poorer quality can seem economical, but in high-temperature operations, performance inefficiencies could lead to greater costs.

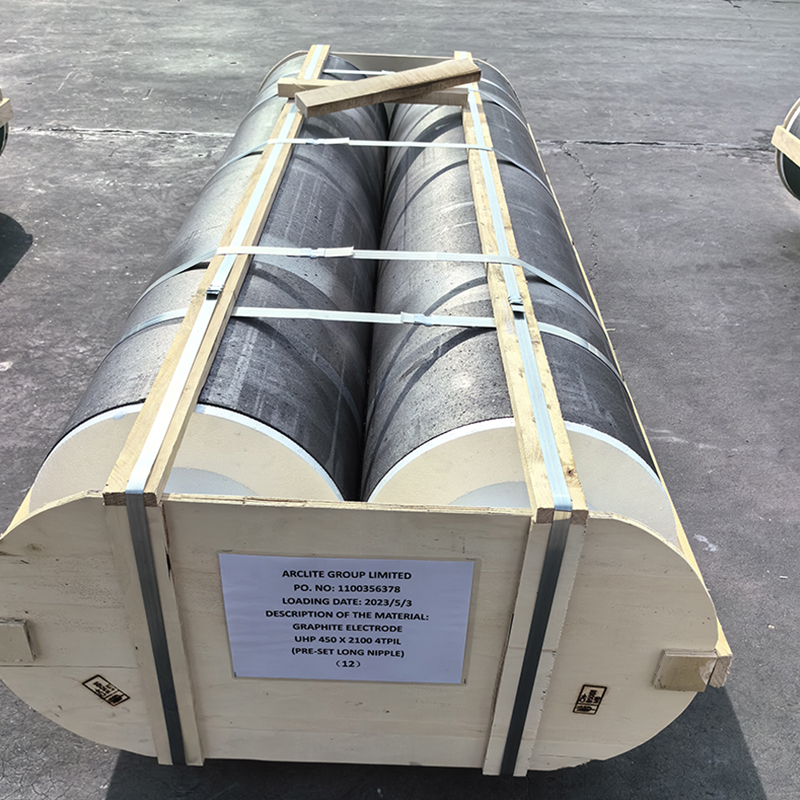

Several manufacturers innovate in production techniques to keep costs down without sacrificing quality. At Hebei Yaofa Carbon Co., Ltd., with over 20 years of experience, they've managed sustainable production methods for graphite additives and electrodes, proving that quality doesn't necessarily equate to exorbitance.

It's essential for buyers to balance initial costs against the crucible's performance lifespan. Sometimes a higher upfront investment pays off in operational savings.

Customization and Its Impact on Pricing

Customization needs often catch companies off-guard. When you require specific dimensions or compositions beyond standard offerings, expect the price to climb. Special orders aren't just about the material but also the precision manufacturing and time it requires.

A case in point: a workshop once needed a specialized batch for a project on silicon carbide, which involved unconventional chemical compatibility. The bidding started heated, and while Hebei Yaofa Carbon Co., Ltd. provided a reasonable offer due to their flexible production capabilities, other suppliers weren't as accommodating.

Custom solutions demand careful coordination with the manufacturer to ensure that specifications are met without unnecessary expenditure. It's wiser to collaborate with experienced providers, like the ones found at Hebei Yaofa Carbon’s extensive production facilities.

Economic and Regional Factors

Beyond intrinsic industry influences, broader economic factors also dictate graphite crucible prices. Currency exchange rates, regional tariffs, and political stability all play parts. For instance, trade relations between graphite-rich countries and consumer regions can shift scales significantly.

I remember during a particular trade dispute period how prices peaked unexpectedly. Manufacturers had to navigate not only production challenges but also diplomatic ones. Hebei Yaofa Carbon Co., Ltd., being anchored in China, a major player in the graphite market, has experienced the swings firsthand.

Regional incentives like tax breaks or environmental regulations can also move the pricing needle. Being aware of these can offer strategic purchasing opportunities.

Market Trends and Future Outlook

As industries evolve, so does the landscape of graphite crucible prices. Emerging technologies might change traditional demand patterns. For instance, the rise of electric vehicles has a profound impact on the materials market, including graphite.

The push for cleaner production methods may introduce both constraints and opportunities. This dynamic keeps companies like Hebei Yaofa Carbon Co., Ltd. innovating and adapting, ensuring they stay competitive as stakeholders in this shifting environment.

Ultimately, navigating graphite crucible pricing isn't just about following current trends—it's about anticipating shifts and making informed choices based on reliable insights and seasoned experience.

Related products

Related products

Best selling products

Best selling productsRelated search

Related search- eaf graphite electrodes supplier

- graphite electrode manufacturer in india

- black coal tar factory

- mg17 coal tar supplier

- China Ultra high power graphite tongs

- China graphite crucible induction heating

- graphite felt electrode Manufacturer

- China black coal tar uses

- industrial coal tar Manufacturer

- Buy coal tar oil