- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

graphite electrode price per kg

Understanding Graphite Electrode Price Fluctuations

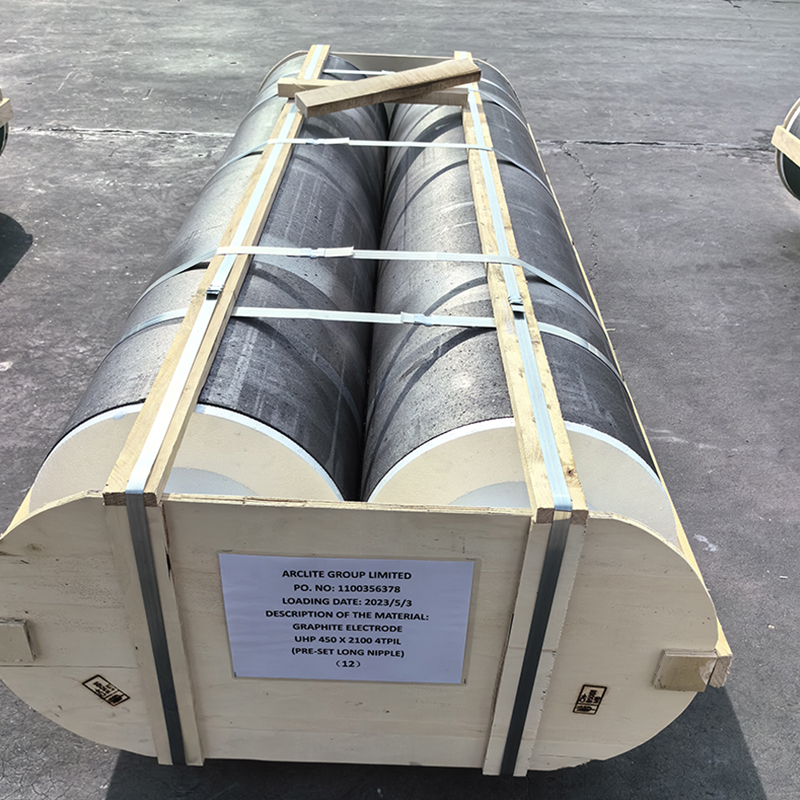

Graphite electrode prices can be a perplexing topic, especially when trying to pin down a consistent price per kg. The market is dynamic, influenced by a blend of factors ranging from raw material costs to geopolitical events. In this discussion, we’ll delve into the variables that affect pricing, guided by experiences from companies like Hebei Yaofa Carbon Co., Ltd., which has been a significant player in this field for over two decades.

Supply and Demand Dynamics

The supply and demand curve is the primary force driving the graphite electrode price per kg. When steel production is high, the demand for graphite electrodes intensifies, subsequently raising prices. In contrast, a slowdown in the industry sees prices tapering off. I recall an instance when a sudden spike in steel production in China led to price surges that left many scrambling.

Hebei Yaofa Carbon Co., Ltd. has adeptly managed these fluctuations by leveraging its extensive network and production capabilities. Their ability to pivot quickly in response to market changes gives them a competitive edge in stabilizing prices for clients. This adaptability is critical, especially when unexpected events occur.

Another layer to consider is the cost of raw materials, primarily needle coke. This is not a detail to bypass, as needle coke prices have their own volatility, making it essential to establish good supplier relationships. Without these insights, making sense of the final electrode pricing remains difficult.

Technological Impacts

Advancements in production technology can also affect the graphite electrode price per kg. For instance, as production processes become more efficient, costs might decrease. But this isn’t a simple correlation, as technology upgrades require significant initial investments.

Hebei Yaofa Carbon Co., Ltd. invests consistently in modernizing equipment, understanding that long-term gains outweigh upfront costs. Watching them develop their UHP/HP/RP grade graphite electrodes provides insight into the delicate balance of innovation and economic feasibility. Be wary of short-term gains that neglect long-range sustainability.

An example here might be the transition to more eco-friendly production methods. While better for the environment, these methods might initially raise production costs, though they often result in better market positioning and customer loyalty in the long run.

Geopolitical and Environmental Considerations

Geopolitical tensions can sometimes ripple through the graphite electrode market. Tariffs, trade restrictions, or diplomatic strains between nations can disrupt supply chains, causing price fluctuations. It’s a realm where the stakes are high, and decisions need a careful approach.

Hebei Yaofa Carbon Co., Ltd., with its base in China, is no stranger to these dynamics. They maintain a robust strategy to mitigate such risks by diversifying both their supply sources and export markets. But it’s not always straightforward; sometimes predictions miss the mark due to unforeseen global events.

Environmental regulations are another factor, particularly strict emission standards. Adapting to these requirements often involves altering production processes, which could reflect on the final price point. However, companies that navigate these meticulously often find new opportunities.

The Role of Industry Relationships

Industry relationships are invaluable; networking can often provide a more stable grounding than data alone. Engaging with other businesses can offer insights into trends and help anticipate shifts before they happen. It’s a lesson learned repeatedly: the market rewards those who connect well.

Hebei Yaofa Carbon Co., Ltd. benefits from its industry connections, providing them with an intangible but potent tool in negotiating rates and securing key deals. They actively participate in industry forums, ensuring they remain at the forefront of market changes.

These collaborations can sometimes provide strategies to buffer against price swings, balancing between securing affordable raw materials and maintaining competitive pricing for finished products—a delicate dance.

The Human Element

At the heart of pricing are the people making decisions. Human judgment—based on skills, experience, and sometimes intuition—can sway prices. Decision-makers in this field often rely on past insights but also need to adapt quickly to new information.

In a fast-paced industry, Hebei Yaofa Carbon Co., Ltd. underscores the importance of keeping a trained eye on the ever-shifting landscape. Their decades in the market have allowed them to build a team adept at navigating these complexities. The raw numbers only tell part of the story; human expertise fills in the gaps.

Ultimately, understanding the graphite electrode price per kg requires an amalgamation of data, experience, relationships, and a dash of intuition. It’s a multifaceted challenge, but with the right approach, it becomes manageable, even predictable to a degree. For those truly immersed in this world, like the professionals at Hebei Yaofa Carbon Co., Ltd., it’s all part of the journey.

Related products

Related products