- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

graphite electrode price today factory

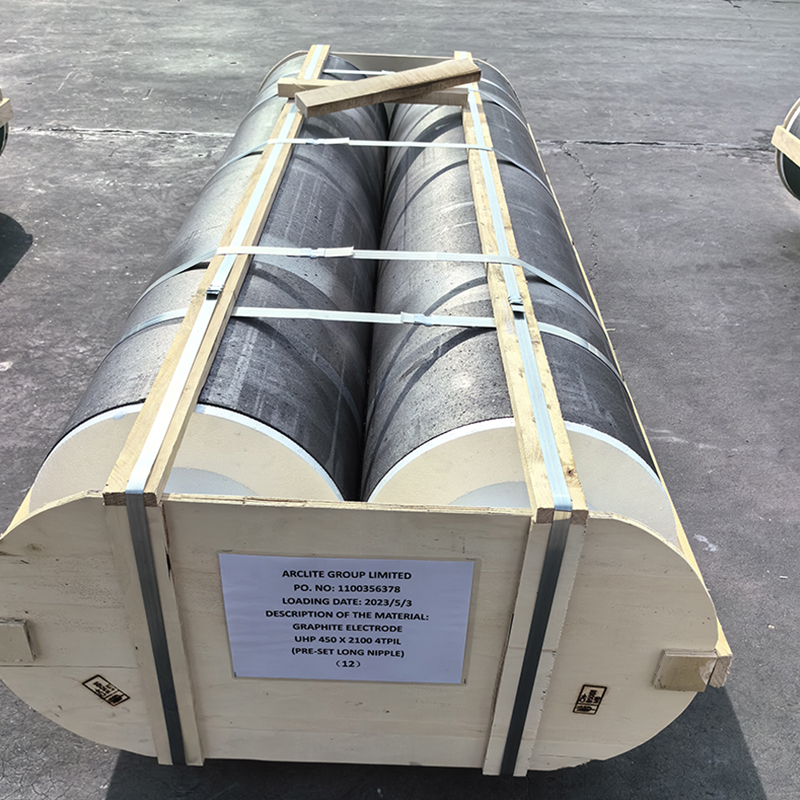

Understanding Today's Graphite Electrode Prices from the Factory's Perspective

Graphite electrode prices today can be quite the puzzle, especially if you're trying to navigate the market with an eye on factory prices. Sure, numbers fluctuate, but what's behind these shifts? What real-world factors should you consider, aside from the obvious? Here's an honest look from someone who's been in the trenches of this industry.

Factors Influencing Graphite Electrode Prices

When it comes to graphite electrode price, the numbers are never just figures on a chart—there's always a story, always real dynamics at play. Supply chain disruptions, for instance, can ripple through the market with unexpected reach. A hiccup in transportation or a raw material shortage impacts prices almost immediately. You can't just look at today's price and assume it stands in isolation—it never does.

Consider production costs. With a factory like Hebei Yaofa Carbon Co., Ltd., which has over two decades in the business, they have a robust understanding of cost management. Still, increasing prices of needle coke, the main raw material for graphite electrodes, can push up production costs considerably.

Then, there's the demand side. Steel manufacturers—key consumers of graphite electrodes—are ramping up production due to infrastructure growth in various parts of the world. This surge in demand can cause prices to rise significantly. Yet, the market is fickle; what swells today might recede tomorrow. It's an endless dance.

Supply Chain Challenges and Adjustments

Seeing these price changes, it's tempting to think a factory can simply adjust production timelines to control costs. But it's not that straightforward. Take Hebei Yaofa Carbon Co., Ltd., for example. They must consider not only raw material availability but also logistical issues, like shipping constraints and labor shortages.

Shipping has been a massive pain point recently. Delays at ports, a shortage of containers, these are issues that compound as you try to meet delivery deadlines. Factories have been forced to reevaluate stock levels, sometimes holding more inventory than they'd typically prefer to buffer against these uncertainties.

Let me tell you, watching a carefully planned schedule crumble under the weight of these obstacles is frustrating. Yet, it's this very challenge that forces factories to innovate, to find new efficiencies, and sometimes pivot in unexpected directions to maintain steady pricing.

Technological Advancements in Production

On a brighter note, technology is reshaping graphite electrode manufacturing. For factories having long-standing experience like those at Hebei Yaofa Carbon Co., Ltd., even subtle upgrades can yield significant savings. Automation in production not only enhances efficiency but reduces errors—critical when every millimeter of precision counts.

Investing in state-of-the-art machinery might seem like a hefty expense upfront, but it becomes a strategic advantage. For instance, modern kilns that consume less energy can substantially reduce overhead costs. This tech-forward approach is crucial in keeping prices stable amidst fluctuating external pressures.

Of course, the transition isn't without bumps. Integrating new technology often comes with a learning curve, not only for machinery but for the people operating them. Training becomes essential, and that's another cost factor, though one that's justified by long-term benefits.

Market Demand Dynamics

The demand for graphite electrodes is highly sensitive to the steel manufacturing sector. As regions embark on significant infrastructure projects, the requirement for steel—and consequently graphite electrodes—inevitably increases. This creates a rush, driving up prices.

Factories must anticipate these booms and deploy strategies to meet demand without overspending. This involves trade-offs, such as deciding whether to scale up production or optimize current outputs further. It's a decision that hangs heavily over every manufacturing unit.

Despite the constant ebb and flow, having a rich history, like Hebei Yaofa Carbon Co., Ltd., offers insights that newer players might lack, such as when to stockpile or sell swiftly. The company is adept at reading market signals and adjusting accordingly.

Strategic Insights and Final Thoughts

It's easy to get lost in the numbers when talking about the graphite electrode price from a factory's viewpoint. But the nuances of production, supply chain adjustments, technological advancements, and market demand all paint a fuller picture. What seems static at a glance is incredibly dynamic, shifting day to day.

One of the valuable takeaways from experience is the importance of flexibility and foresight in navigating these waters. Companies that are nimble and can adjust to external pressures swiftly tend to thrive.

Hebei Yaofa Carbon Co., Ltd., with their seasoned understanding of market dynamics and technological investment, embodies such adaptability. You can explore their offerings and innovative solutions at https://www.yaofatansu.com. Whether you're in the industry or just curious about these processes, recognizing the complexity behind pricing is vital. It's not just about today's price; it's about understanding the myriad factors that influence it daily.

Related products

Related products