- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

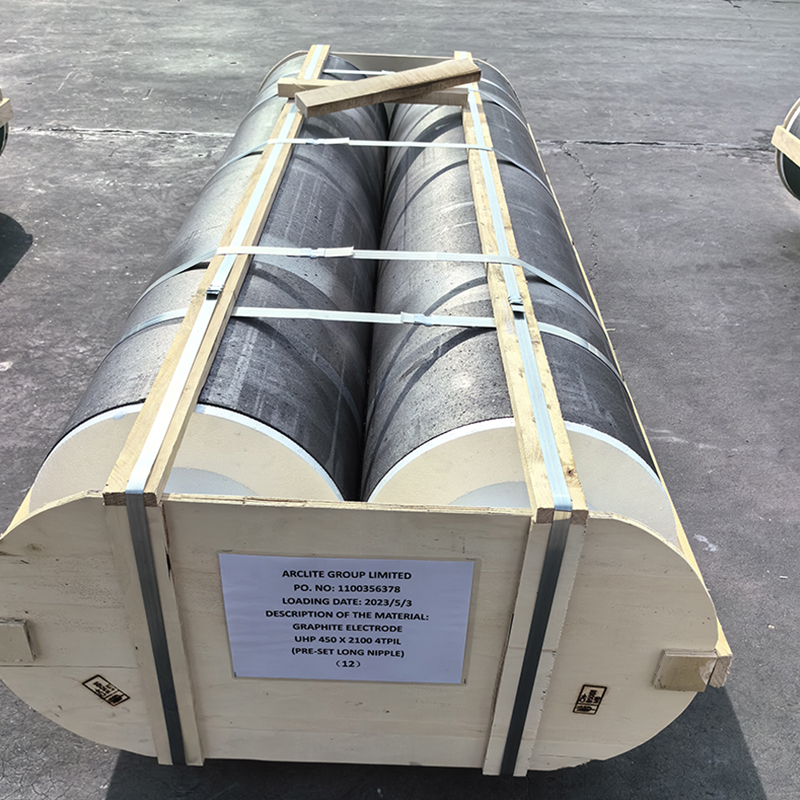

graphite electrode price today Manufacturer

The Complex Dynamics of Graphite Electrode Pricing

Understanding the fluctuations in graphite electrode prices can be a headache, even for seasoned professionals. Whether you're a manufacturer or simply dealing with suppliers, the factors influencing these prices are both vast and intertwined. Let’s dive into the reality of the market today, drawing from practical industry insights.

Key Factors Influencing Graphite Electrode Prices

At the core, the price of graphite electrodes is driven by supply and demand dynamics. But it's not just about availability in the market. The real complexity lies in the raw materials: petcoke and needle coke. These materials are subject to their own supply chain issues, ranging from geopolitical tensions affecting oil prices to environmental regulations impacting production capabilities.

For instance, Hebei Yaofa Carbon Co., Ltd., with over 20 years of experience, emphasizes the need for a stable supply chain. Being a large player in China, they often encounter fluctuating material costs, which directly impacts their pricing strategy. Their website, yaofatansu.com, offers more insights into their approach to these challenges.

Moreover, environmental policies continue to play a significant role. Recent Chinese regulations aimed at controlling carbon emissions have led to tighter controls on production processes, inevitably causing price variations. These regulations can result in either a surge in short-term costs or a longer-term stability, depending on various geopolitical factors.

Market Demand and Its Ripple Effects

Beyond raw materials, consider the demand from the steel industry, which is the primary consumer of graphite electrodes. A resurgence in steel production, whether due to infrastructure projects or increased manufacturing activities, typically spikes electrode demand. This demand surge often escalates prices, sometimes unpredictably.

Take, for example, a scenario where a major infrastructure bill passes in the U.S. Such an event can lead to a rapid increase in steel production needs, sending ripple effects across the globe. Manufacturers everywhere, including those at Hebei Yaofa Carbon Co., Ltd., must adapt quickly, either ramping up production or adjusting their pricing strategies.

Occasionally, manufacturers might hedge against such uncertainties by stockpiling critical materials. Yet, it’s a gamble—holding inventory ties up capital and risks losses if prices drop unexpectedly. The decision-making process is a complex blend of analytics and educated guesses.

Technological Advancements Impacting Production

Technological innovations also impact graphite electrode prices. Improving production efficiency without sacrificing quality is a continuous goal for leading manufacturers. Hebei Yaofa Carbon Co., Ltd. has invested heavily in advanced manufacturing techniques to optimize their production lines.

Incorporating cutting-edge technology can reduce waste and improve the yield of usable electrodes, impacting both cost and price. However, such investments require substantial capital and carry the risk of technological obsolescence.

Moreover, these advancements must align with industry standards and customer expectations. Failure to meet these can lead to severe market penalties, making technology both an opportunity and a challenge.

Currency Fluctuations and Financial Hedging

An often-overlooked factor is the impact of currency exchange rates. As a manufacturer in China dealing with international clients, Hebei Yaofa Carbon Co., Ltd. experiences firsthand the implications of exchange rate fluctuations.

Securing long-term contracts in U.S. dollars can provide stability, but it also exposes the company to currency risk. Such financial dynamics require robust hedging strategies to mitigate potential losses. It’s an area where expertise in both finance and production becomes invaluable.

Thus, companies must maintain a delicate balance between locking in advantageous contracts and retaining flexibility to adapt to currency changes. It's a tightrope walk that few manage to master successfully.

Future Projections and Strategic Adjustments

Looking ahead, the landscape of graphite electrode pricing is likely to remain volatile. Market leaders must anticipate shifts not only in the technological realm but also in global trade policies and environmental regulations.

Hebei Yaofa Carbon Co., Ltd., by continuously reviewing its strategic positioning and adapting to market dynamics, provides a relevant case study of resilience and foresight. Such adaptability is crucial for navigating the unpredictable waves of global trade and production.

In the end, the price of graphite electrodes is dictated by a complex interplay of factors. It's not just about numbers or forecasts on a screen; it's about understanding the real-world implications of each decision and adapting accordingly. This comprehension roots from years of experience and keen market observation—core attributes that distinguish leaders from followers in this intricate industry.

Related products

Related products