- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

graphite electrode spot price

Understanding the Market Dynamics of Graphite Electrode Spot Price

When it comes to tracking the graphite electrode spot price, many industry newcomers anticipate a straightforward process. The reality, however, is tangled in a web of market variables and industrial nuances. My experiences in the field, particularly with Hebei Yaofa Carbon Co., Ltd.—a prominent Chinese manufacturer—have provided a unique perspective on this subject.

The Art of Pricing

The price of graphite electrodes is not just about supply and demand; it's a complex interplay of raw material availability, energy costs, and geopolitical stability. For instance, needle coke, a primary raw material, often sees a volatile market based on these factors. Many overlook how critical these raw materials are in influencing the final pricing.

In my dealings, especially with experienced manufacturers like Hebei Yaofa Carbon Co., Ltd., the emphasis is always on securing stable raw material sources. Their keen eye for sourcing and foresight in inventory management significantly impact their pricing strategies, ensuring they remain competitive even when the market is turbulent.

This observation is not just from sitting in an office but stems from site visits and conversations with operational managers who live these challenges daily. The delicate balance between cost management and competitive pricing remains an ongoing endeavor.

Market Demand Fluctuations

The demand for graphite electrodes correlates closely with the steel industry's health. However, it’s not a one-to-one relationship. Regional demand differences often skew the global picture substantially. For example, an uptick in China's steel production doesn't necessarily translate globally, impacting how companies like Hebei Yaofa Carbon Co., Ltd. adjust their strategies.

Their adaptability is notable, reflecting over 20 years of industry experience (as seen on their website, https://www.yaofatansu.com). This historical data drives a nuanced understanding of market trends, where short-term spikes are often viewed with a skeptical eye to avoid reactionary pricing shifts that can harm long-term relationships with clients.

These insights often emerge from sharing sessions and industry conferences where real-world experiences provide a clearer picture than any spreadsheet could.

Technological Advances and Their Impact

The narrative around graphite electrodes isn't solely about numbers. Technological innovations in production and application are significant influencers. As companies like Hebei Yaofa embrace cutting-edge production techniques, these advances can lead to a more efficient market supply, potentially stabilizing spot prices over time.

However, the implementation of technology is not without its challenges. Retrofitting production lines and the learning curve for new processes can initially spike operational costs. This phase is critical, as seen in Hebei Yaofa's meticulous approach to integrating upgrades over the years.

These technological investments, while initially costly, foster a long-term competitive edge by enhancing production efficiency and product quality, crucial factors for adjusting to price volatilities.

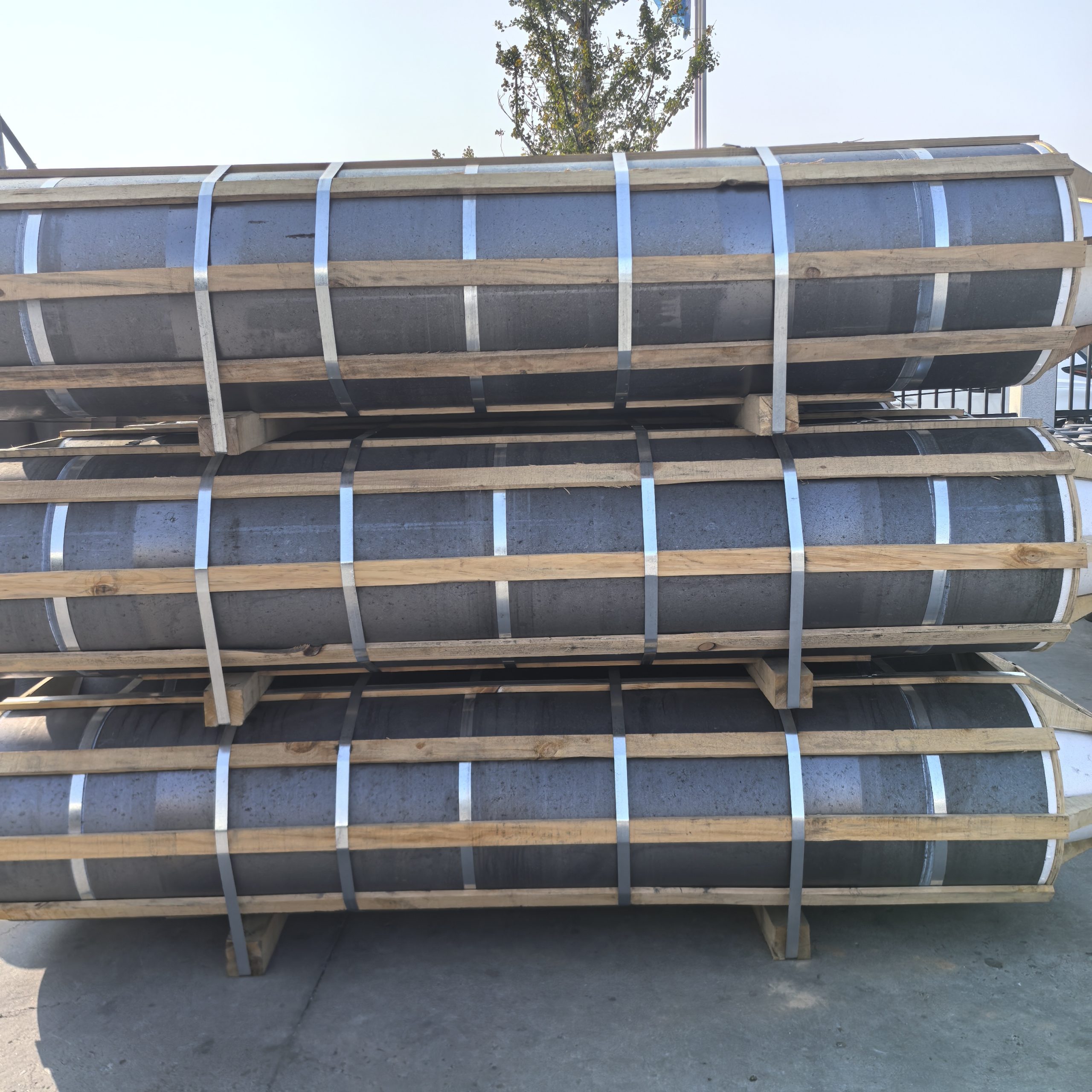

Logistical Challenges

Logistics, often an ignored back-end operation, plays a monumental role in the ultimate spot pricing of marine-shipped goods. My time working with logistical teams has underscored how shipping delays, tariff changes, and even port blockages directly impact costs.

Companies like Hebei Yaofa, with their extensive experience, tend to have established networks minimizing such risks. Strategic partnerships and diversified shipping routes, informed by years of learning and adjustments, minimize unexpected costs which might otherwise inflate market prices.

It's this kind of foresight and logistical acumen that frequently gets mistaken for mere luck when in reality, it's the result of a deeply ingrained expertise developed over decades.

Navigating Futures and Contracts

Beyond the spot market, futures contracts often play a critical role in hedging against price volatility. Negotiating these requires not just an understanding of current market conditions but also projections of future trends. Companies like Hebei Yaofa often engage in these practices, leveraging their comprehensive market knowledge.

It's a delicate art—commit too early, and one risks locking in unfavorable rates; delay too long, and the window of opportunity might close. Such decisions are never made lightly and always involve input from multiple departments to weigh potential risks and benefits thoroughly.

This layered approach often leads to successful negotiations where both company stability and client relations are prioritized, showcasing the multifaceted nature of managing graphite electrode pricing in modern markets.

Related products

Related products

Best selling products

Best selling products-

Graphite plate

Graphite plate -

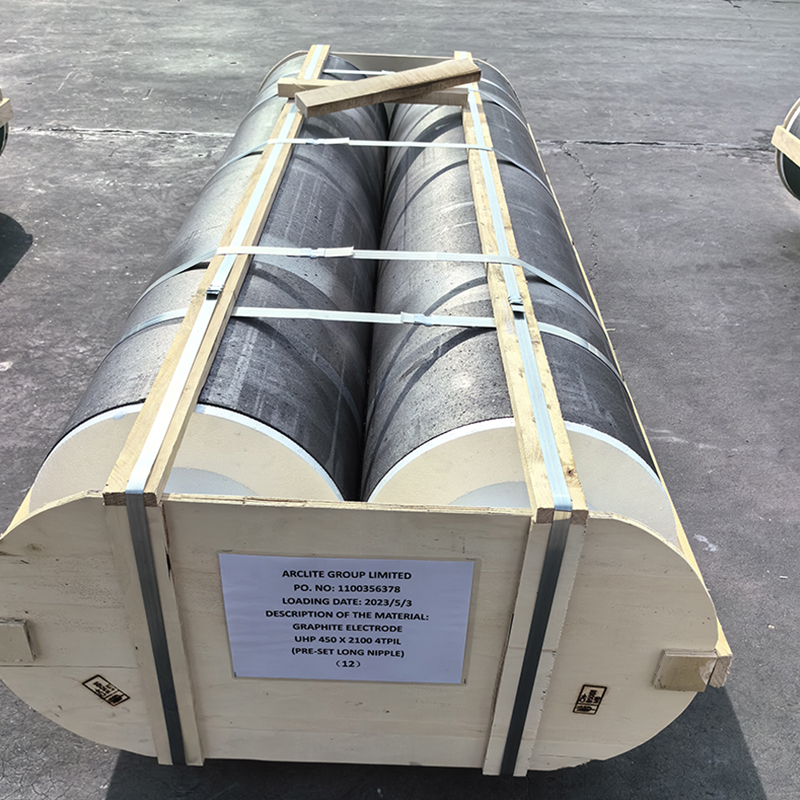

UHP ultra high power graphite electrode

UHP ultra high power graphite electrode -

Granular carburizer

Granular carburizer -

RP normal power graphite electrode

RP normal power graphite electrode -

Ultra-High Power Graphite Electrode

Ultra-High Power Graphite Electrode -

High-quality graphite powder available in stock, with a full range of specifications and customizable options.

High-quality graphite powder available in stock, with a full range of specifications and customizable options. -

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces.

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces. -

Graphite Crucible

Graphite Crucible -

Spherical carburizer

Spherical carburizer -

HP high power graphite electrode

HP high power graphite electrode -

High-power graphite electrodes, 600 mm diameter, for export.

High-power graphite electrodes, 600 mm diameter, for export. -

A supplier of graphite electrodes with a global distribution network.

A supplier of graphite electrodes with a global distribution network.

Related search

Related search- cheap digital signage

- China tempering a graphite crucible

- graphite melting crucible factory

- coal tar for sale Manufacturer

- China graphite heat transfer plates

- Graphite recarburizer Manufacturer

- amazon graphite crucible supplier

- 2kg graphite crucible Manufacturer

- prefab bus shelters

- China graphite electrode company