- English

- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

graphite electrode price factory

Understanding the Dynamics of Graphite Electrode Pricing

In the maze of industrial materials, the market for graphite electrodes often sparks curiosity. While many assume it’s just about raw material costs or production techniques, there’s far more beneath the surface. Having navigated this field myself, I’ve seen firsthand how factors like global demand, supply chain nuances, and technological shifts play roles.

Diving Into the Price Structure

Unlike some might think, the graphite electrode price isn’t merely dictated by the price of raw materials. From my experience, a single unexpected event on the global stage, be it a trade policy shift or a natural disaster, can ripple through the supply chain, affecting costs. This is something I've had to monitor constantly while working in the industry.

A key player in the game is the production process itself. Companies like Hebei Yaofa Carbon Co., Ltd., which you can find more about on their website, employ advanced manufacturing techniques honed over 20 years. This experience often allows them to offer competitive pricing by optimizing their processes.

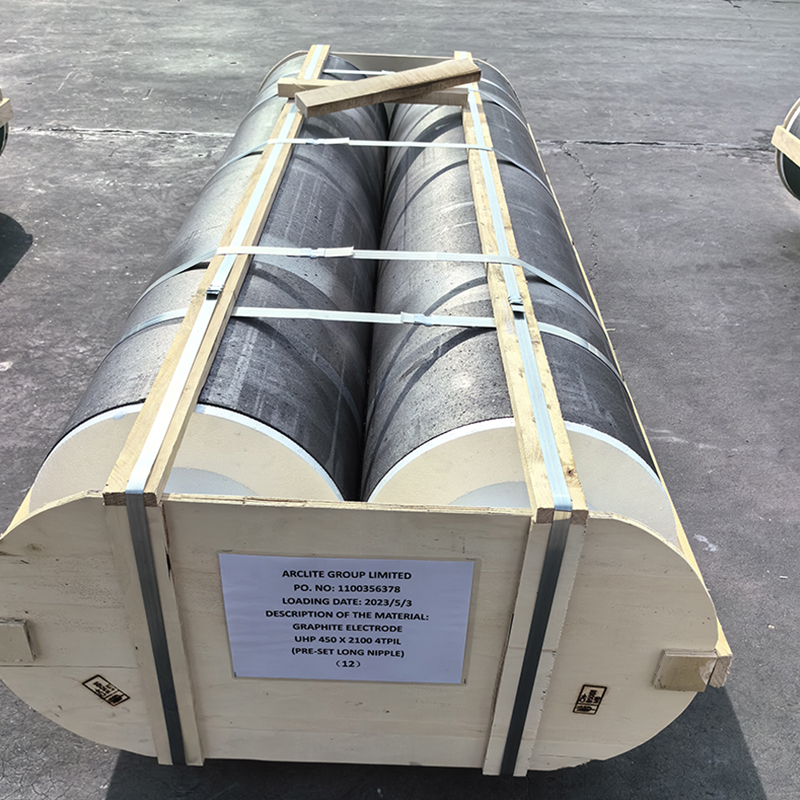

It's not always straightforward, though. There are times I've had to dissect supply contracts, weighing the benefits of different grades like UHP, HP, and RP. Each has its unique market value and production requirement, all influencing the price.

Global Demand Fluctuations

Markets are ever-changing, something that’s especially true for graphite electrodes. From my vantage point, heavy industries such as steel manufacturing significantly drive demand. These sectors rely heavily on quality electrodes, making the demand fluctuate with their production cycles.

I've noticed that during economic booms, the scramble for high-grade electrodes intensifies, impacting pricing. Understanding the cyclical nature of these industries is something I've learned to factor into strategic planning.

Hebei Yaofa Carbon Co., Ltd. keeps a pulse on these trends through their extensive network and longstanding industry experience. This allows them to adapt quickly, ensuring that their pricing remains competitive amidst changing demands.

Regional Supply Chain Challenges

Whenever I’ve dealt with supply chains, regional challenges often present hidden hurdles. Transportation, political stability, and even weather can impact availability. I remember a particular incident when a supply chain disruption due to adverse weather escalated costs unexpectedly.

From where I stand, having a reliable network is crucial. Companies like Hebei Yaofa leverage their presence across regions to mitigate these risks effectively. Their approach reduces the impact of local disruptions on global pricing.

It's experiences like these that highlight why comprehensive supply chain strategies are critical. The lessons learned from navigating these complexities often prove invaluable.

The Role of Technology

Technological advances often redefine the landscape of graphite electrode manufacturing. During my tenure in the industry, I've witnessed how automation and innovation have streamlined production, creating efficiencies that translate to cost benefits.

Companies investing in tech are usually the ones leading in pricing strategies. Hebei Yaofa’s investment in state-of-the-art facilities is a strong example of how embracing technology can offer a competitive edge. You can see more on this on their website.

However, adopting new technology is not without its challenges. Balancing initial investments against long-term savings requires careful consideration, something that has required my dedication numerous times.

Navigating Supplier Relationships

Building and maintaining supplier relationships is another layer that impacts graphite electrode pricing. In my experience, fostering strong ties with suppliers can often soften the blow of volatile market shifts.

I've learned that open communication and trust can lead to better terms, flexibility, and even priority access during high-demand periods. It's relationships like these that Hebei Yaofa nurtures, ensuring a robust supply chain.

So, whether you're sourcing directly or through intermediaries, taking the time to cultivate these connections can provide substantial long-term benefits, especially in a market as dynamic as graphite electrodes.

Related products

Related products