- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

price of graphite electrode

Understanding the Pricing Dynamics of Graphite Electrodes

The price of graphite electrode is a hot topic for anyone involved in the steel manufacturing industry. It's a complex mix of market forces, production costs, and raw material availability. Many overlook the importance of these factors, leading to misconceptions about pricing stability. Exploring these nuances offers a clearer view of what truly influences costs.

Market Forces at Play

To truly understand the pricing dynamics, one has to consider global steel production levels. Graphite electrodes are essential in electric arc furnace (EAF) steelmaking, and as such, their demand directly correlates with steel output. When steel production ramps up, so does the demand for graphite electrodes, often leading to price hikes. But it's never just that simple.

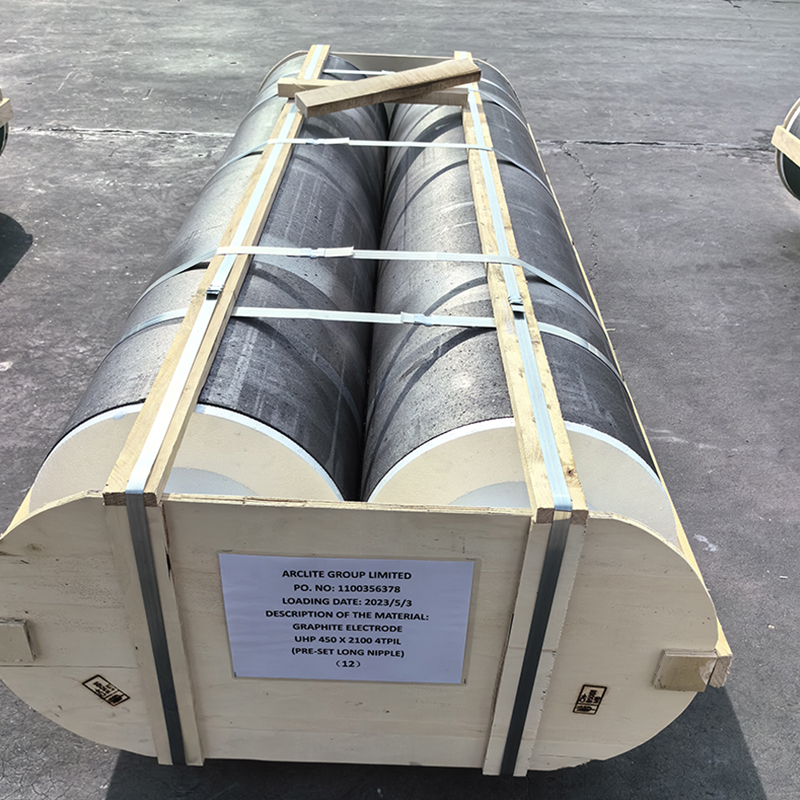

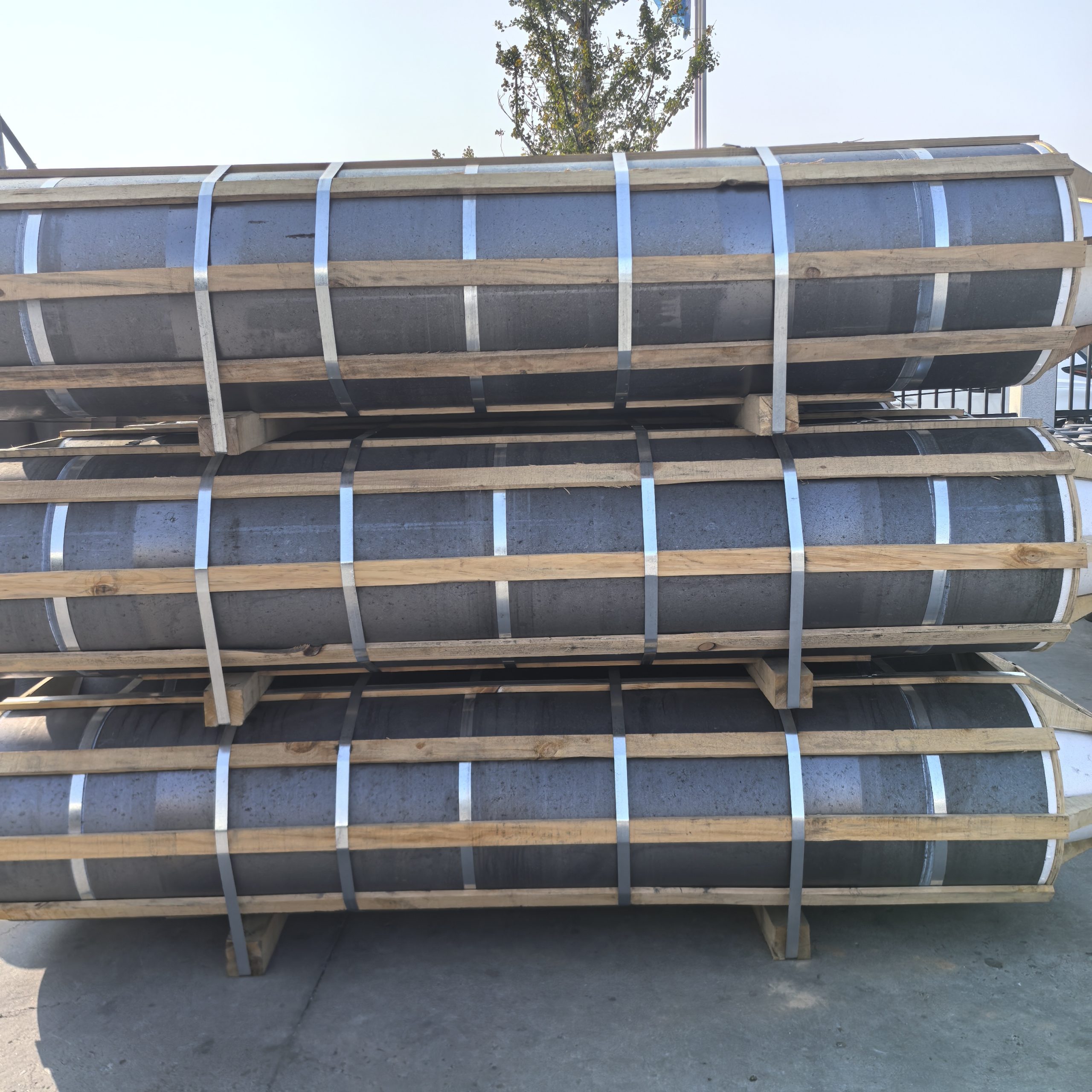

Another factor is China's role as a major player in the carbon market. As Hebei Yaofa Carbon Co., Ltd. demonstrates, with more than 20 years of experience, China can wield significant influence. Their ability to produce high-quality electrodes, like UHP and HP grades, means they are a key supplier to watch. Shifts in China's production or export policies can ripple across the market.

Despite stable demand, unexpected geopolitical events or raw material shortages can cause sudden price fluctuations. The cost of needle coke, a core component, has its own set of influences—energy costs, supply disruptions, and even regulatory changes. Vigilance in monitoring these areas is crucial for anyone depending on graphite electrodes.

Production Costs and Challenges

Another often misunderstood aspect is the cost of production itself. At Hebei Yaofa Carbon Co., Ltd., the process of manufacturing graphite electrodes is meticulous and resource-intensive. This includes everything from sourcing quality raw materials like petroleum coke to precise manufacturing methods.

ROD breakdown and baking, pitch impregnation, and graphitization—all these stages have significant energy and labor costs. Moreover, maintaining stringent quality control measures incurs additional expenses. For a company with stringent standards like Hebei Yaofa, meeting quality expectations while controlling costs requires constant optimization.

Environmental regulations also play a part. Meeting these standards can be costly but essential for any serious manufacturer. The knack lies in balancing these compliance costs with competitive pricing. Hebei Yaofa, with its adept production strategies, manages to maintain this balance, ensuring the products meet international market demands.

Supply Chain Complexities

Sourcing and logistics present their own set of hurdles. A stable pricing strategy for graphite electrodes requires a reliable supply chain, which is often easier said than done. Weather, political instability, and logistical bottlenecks can disrupt supply lines, affecting graphite electrode availability and pricing.

Hebei Yaofa Carbon Co., Ltd.'s approach involves building strong relationships with raw material suppliers and ensuring diversified supply channels. This strategy minimizes risks associated with supply disruptions, allowing the company to offer consistent pricing to its customers.

However, unexpected shifts in demand, such as a surge in steel production, can strain even the best-prepared supply chains. Having flexible logistics solutions in place helps navigate these peaks without severe pricing repercussions.

Adapting to Market Changes

The key to managing the price of graphite electrode also lies in the ability to adapt. Understanding market signals and responding accordingly can make a significant difference. Hebei Yaofa's extensive experience is a testament to their agility and responsiveness to market changes.

For instance, by investing in technology and innovative production techniques, Hebei Yaofa can adjust its output to match market demand without compromising on quality. This adaptability is crucial in a sector where market conditions can change rapidly.

Additionally, maintaining a keen eye on competitor strategies provides insights into potential market shifts, allowing Hebei Yaofa to preemptively adjust its own approaches, ensuring they remain competitive without sacrificing margins.

Future Outlook

Looking ahead, the industry faces both opportunities and challenges. With evolving technologies in steel production, the demand for high-grade graphite electrodes is expected to rise. Companies like Hebei Yaofa Carbon Co., Ltd., with their robust production capabilities, are well-positioned to capitalize on these trends.

However, the future will also involve navigating new regulations and technological advances in the carbon industry. Those who can innovate and adapt will be better placed to maintain favorable pricing structures while expanding their market reach.

In conclusion, understanding the intricate dynamics that affect the price of graphite electrode requires an appreciation of both industry-specific factors and broader market forces. For those embedded in the field, it's a delicate dance of strategy, planning, and adaptability. Hebei Yaofa Carbon Co., Ltd. exemplifies this balance, providing insights into the complexities and rewards of the graphite electrode market.

Related products

Related products

Best selling products

Best selling products-

Graphite plate

Graphite plate -

UHP ultra high power graphite electrode

UHP ultra high power graphite electrode -

High-power graphite electrodes, 600 mm diameter, for export.

High-power graphite electrodes, 600 mm diameter, for export. -

Spherical carburizer

Spherical carburizer -

HP high power graphite electrode

HP high power graphite electrode -

A supplier of graphite electrodes with a global distribution network.

A supplier of graphite electrodes with a global distribution network. -

Columnar carburizer

Columnar carburizer -

Ultra-High Power Graphite Electrode

Ultra-High Power Graphite Electrode -

Graphite Crucible

Graphite Crucible -

Granular carburizer

Granular carburizer -

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces.

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces. -

RP normal power graphite electrode

RP normal power graphite electrode