- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

price of graphite electrode Manufacturer

The Dynamics of Graphite Electrode Pricing for Manufacturers

Getting a grasp on the price of graphite electrode manufacturer scene can be challenging, with numerous factors influencing costs. Manufacturers, suppliers, and end-users often find themselves navigating a complex web of supply chains, raw material availability, and technological advancements. Below is a perspective from someone who has been in the trenches, navigating these challenges with practical insights and observations.

Understanding Market Influences

What many newcomers fail to recognize is that graphite electrode pricing isn't just about material costs. It's a dance with market forces. Anything from energy prices to geopolitical tensions can ripple through, altering price structures unexpectedly. For example, a sudden spike in electricity costs can inflate manufacturing expenses, as seen in multiple occurrences over the past decade.

In practice, this means having eyes not just on the immediate suppliers but also on regional developments that might impact raw material flows. For instance, Hebei Yaofa Carbon Co., Ltd., a significant player with its base in China, often monitors such variables to adjust strategies accordingly.

Some manufacturers, particularly those like Hebei Yaofa Carbon Co., Ltd., enhance their resilience by diversifying resources, ensuring they're not too reliant on a single input. This is crucial in a domain where unpredictability reigns.

Technological Advancements and Their Impact

Another dimension worth mentioning is the impact of technology. New production techniques can immensely influence costs, either by streamlining operations or shifting raw material dependencies. Investing in advanced technologies often comes with upfront costs but can lead to significant savings in the long run.

In a practical context, I've witnessed Hebei Yaofa Carbon Co., Ltd. (https://www.yaofatansu.com) leveraging its more than 20 years of experience to integrate cutting-edge processes. This not only optimizes production but also subtly shifts how pricing structures are framed.Graphite electrode manufacturers like them often set benchmarks in this ever-evolving landscape.

For those in procurement, keeping an ear to the ground regarding technological shifts can provide competitive advantages, particularly when negotiating long-term contracts.

Supply Chain Complexities

Of the many challenges, supply chain disruptions are perhaps the most daunting. In recent years, global events have emphasized how a hiccup somewhere can resonate across industries. For graphite electrode manufacturers, securing a steady flow of raw materials is often more intricate than it appears.

Engagements with suppliers need to be robust, with contingency plans in place. Companies like Hebei Yaofa are adept at nurturing strong relationships upstream, which acts as a shield against volatility.

Real-world scenarios highlight the importance of local alternatives. During a disruption, those who've cultivated regional options often manage to maintain output and keep pricing competitive.

Regulatory and Environmental Considerations

Regulation adds another layer of complexity to pricing strategies. Stricter environmental policies can inflate operational costs, something that has been particularly prominent in regions pushing for greener practices.

Manufacturers navigating these waters often engage in proactive adaptation, anticipating changes before they hit. Hebei Yaofa Carbon Co., Ltd., for example, has mechanisms in place to align with evolving standards, ensuring compliance without compromising on cost-efficiency.

Balancing regulatory adherence with profitability is a tightrope walk, but necessary for sustained competitiveness.

Strategic Pricing and Market Positioning

Finally, understanding the intricacies of strategic pricing is key. It's not just about setting a number but about positioning in the market. Within the world of graphite electrodes, being cost-competitive while ensuring quality can be the difference between flourishing and floundering.

Manufacturers like Hebei Yaofa, with a strong legacy, leverage experience to position their products adeptly in various markets, offering not just products but reliable partnerships.

To sum up, the price of graphite electrode manufacturer realm is a tapestry woven from diverse threads—experience, adaptability, and foresight being among the most crucial. As with most industry dynamics, those who can see the bigger picture and act swiftly tend to lead the charge.

Related products

Related products

Best selling products

Best selling products-

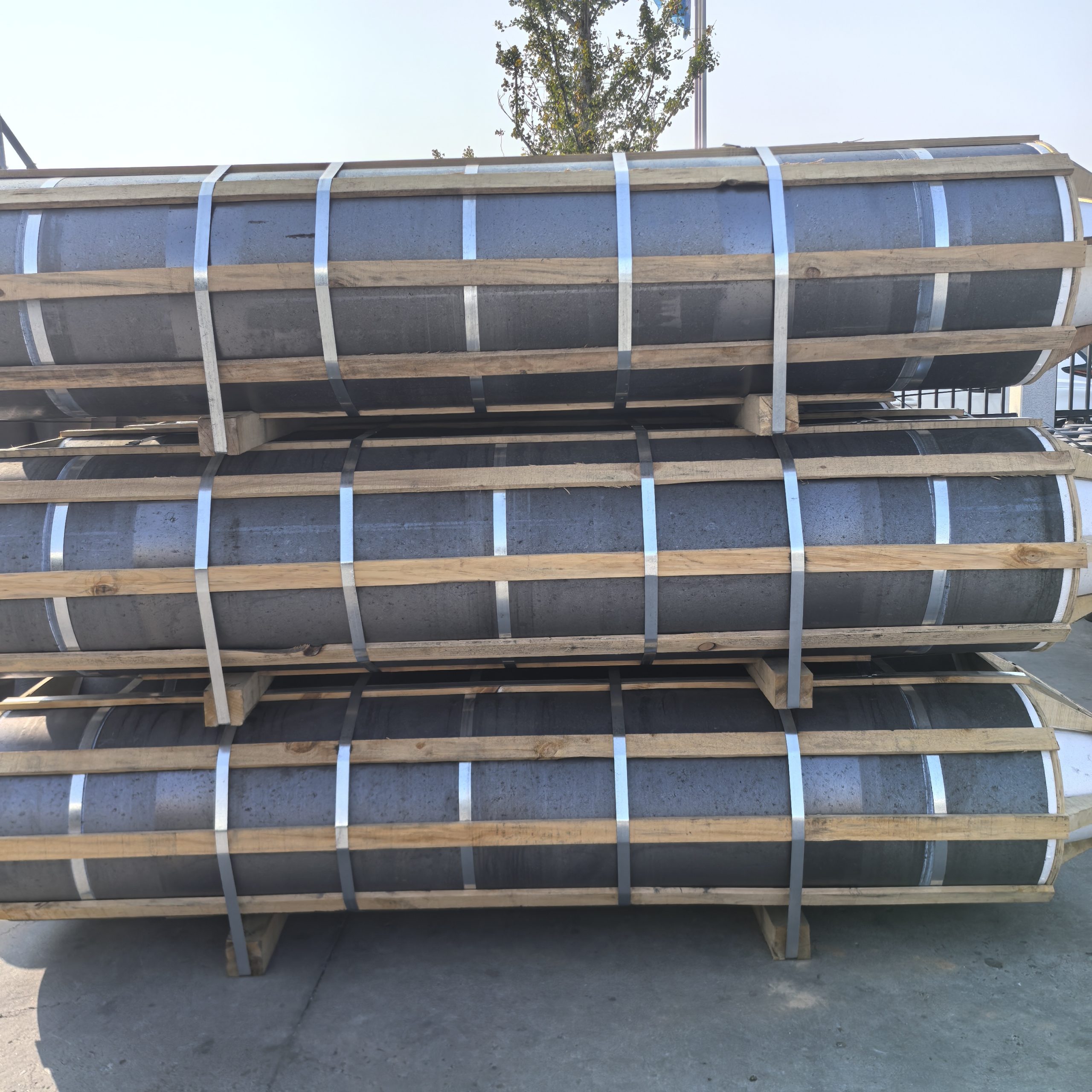

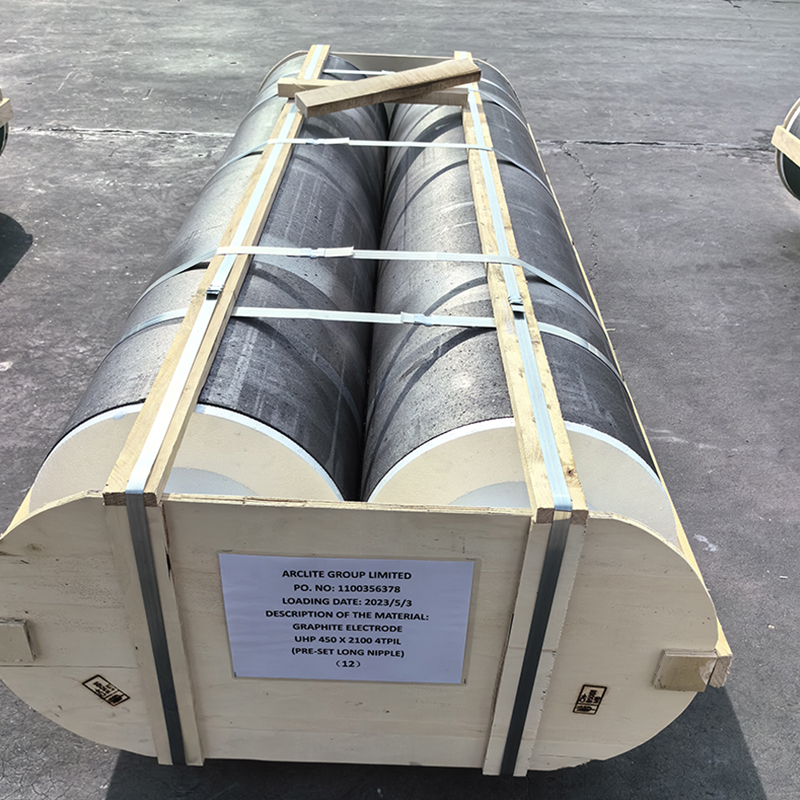

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces.

Factory direct sale! UHP ultra-high power electrodes, specifically designed for electric arc furnaces and refining furnaces. -

Columnar carburizer

Columnar carburizer -

Graphite plate

Graphite plate -

Ultra-High Power Graphite Electrode

Ultra-High Power Graphite Electrode -

Granular carburizer

Granular carburizer -

Graphite Crucible

Graphite Crucible -

A supplier of graphite electrodes with a global distribution network.

A supplier of graphite electrodes with a global distribution network. -

Spherical carburizer

Spherical carburizer -

HP high power graphite electrode

HP high power graphite electrode -

High-power graphite electrodes, 600 mm diameter, for export.

High-power graphite electrodes, 600 mm diameter, for export. -

RP normal power graphite electrode

RP normal power graphite electrode -

UHP ultra high power graphite electrode

UHP ultra high power graphite electrode