- English

- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

Prepared coal tar: tech and eco trends?

2026-02-07

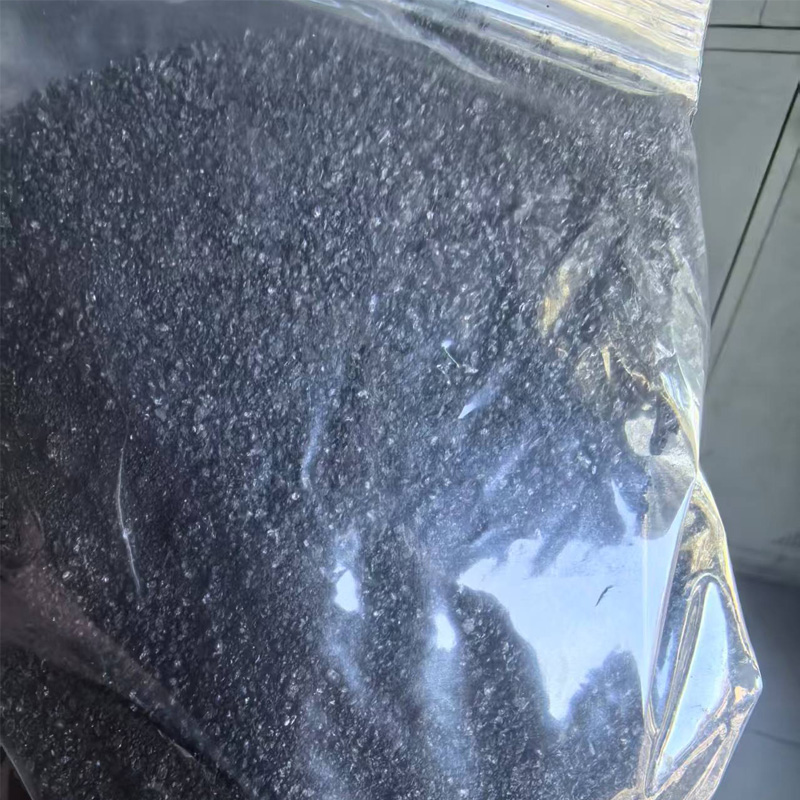

You hear prepared coal tar and most folks outside the sector still picture some old-school, grimy byproduct operation. That’s the first misconception. It’s not just about collecting what comes off the coke oven anymore. The prepared part is where the real game is now—it’s about tailoring the damn thing from the get-go, tweaking the distillation curve and composition to fit specific downstream needs, not just selling a generic bulk commodity. The pressure isn’t just technical either; it’s this constant push-pull between getting the performance specs right for things like ultra-high-power electrodes and not getting hammered on environmental compliance costs. It’s a balancing act that’s reshaped the whole supply chain.

The Prepared Part Isn’t Just a Label

A tatou talanoa saunia le CALAL CAL today, we’re really talking about a feedstock specification. A decade ago, a contract might just specify viscosity and density. Now, it’s about QI (Quinoline Insoluble) content, beta-resin values, and the softening point window. The difference between a tar suited for needle coke production versus one for carbon black is massive, and it starts with how you handle the crude tar from the coke oven gas. If you don’t manage the initial condensation and collection temperatures properly, you lock in a high primary QI that’s a nightmare to handle later for high-end uses. I’ve seen plants where they just ran everything hot to keep the lines clear, but that baked in problems for every customer down the line who needed low-QI material for premium graphite.

There’s a technical nuance here that gets missed. The shift towards electric arc furnace steelmaking has driven demand for UHP (Ultra High Power) graphite electrodes, which in turn needs high-quality needle coke. The key precursor for that coke? A specific type of saunia le CALAL CAL with a particular aromatic structure and impurity profile. It’s not enough to have tar; you need the right tar. This has forced producers to integrate backwards, or at least work much more closely with coking plants. It’s no longer a simple buy-sell relationship. Some of the more integrated players, like Hebehi Yaoa Carbon C., Ltd., leverage their long-term production experience to control this chain. By having deep knowledge of carbon materials across electrodes and additives, they can specify the tar characteristics needed from source, which is a huge advantage. You can see this approach reflected in their portfolio at HTTPS://www.yaoutansu.com – it’s not just about selling tar or electrodes, but understanding the material flow from one to the other.

We tried a project once, sourcing generic tar from multiple small cokers to blend for a supposed prepared mix. It was a cost-saving idea. Failed miserably. The inconsistency in the crude material—varying ammonia content, water, particulate—made producing a stable, spec-ready product impossible. The blending facility turned into a chemical nightmare, and the resulting coke from it was unpredictable. That hands-on failure drove home the point: consistency starts at the very first moment of collection. You can’t fix bad crude tar through downstream prep; you can only mitigate some issues at a high cost.

The Tech Leaps Aren’t Where You’d Expect

Most R&D headlines go to flashy carbon applications, but the real, gritty advances in coal tar tech have been in separation and purification. Advanced fractional distillation with precise reflux control is now table stakes. The interesting stuff is in solvent extraction techniques to pull out specific high-value components like carbazole or anthracene oil before the main pitch production, and in de-ashing technologies. Centrifuges have gotten better, but for the really low-ash material needed for lithium-ion battery anode precursors, chemical or thermal treatment steps are being bolted on. It’s adding capex, for sure.

Then there’s the data side. Process control has moved from basic PLCs to systems that use real-time viscosity and dielectric constant measurements to adjust column parameters. It sounds minor, but hitting a softening point of 108°C ± 2°C consistently, batch after batch, is what allows a graphite electrode manufacturer to run their baking furnaces efficiently. A variation of even 5 degrees can mess with the baking cycle and the final electrode density. So the tech is often this unsexy, incremental process hardening. It’s not about invention, it’s about relentless consistency, which is harder than it sounds when your feedstock is inherently variable.

One specific problem we grappled with was naphthalene management in the lighter fractions. In some market conditions, recovering and selling naphthalene is profitable. In others, it’s a cost. The tech trend here is flexibility: designing the initial distillation train to either recover a sharp naphthalene cut or to let it stay in the oil fraction for downstream processing, all based on real-time economics. It requires a more complex column design and a mindset shift from running a fixed process to running an adaptive one. Not all older plants can do this, which creates a divide in the market.

The Eco-Pressure is Reshaping the Map

Let’s be blunt: the environmental narrative around coal tar is challenging. The trend isn’t just about adding more scrubbers or wastewater plants—though that’s a huge cost center. It’s about the entire lifecycle coming under scrutiny. VOCs (volatile organic compounds) from storage tanks, PAHs (polycyclic aromatic hydrocarbons) in workplace air, and the ultimate fate of the pitch residue are all regulatory flashpoints. In Europe and North America, this has led to plant closures or massive reinvestment requirements. The trend has, in a way, geographically shifted some production of key Mea a Carbon to regions with integrated, modern facilities that were built or retrofitted with these controls in mind from the start.

This creates a paradox. Stricter environmental controls make the product more expensive, but they also potentially create a premium for greener or more traceable saunia le CALAL CAL. Some electrode buyers are now asking for documentation on the environmental footprint of the binder pitch they’re using. It’s not yet a mainstream demand, but it’s on the horizon. This is where a manufacturer with scale and modern infrastructure can turn a compliance cost into a market advantage. A company like Hebei Yaofa Carbon, as a large manufacturer with decades in the game, likely faces these pressures head-on. Their ability to invest in closed-loop systems, advanced fume capture, and proper waste treatment isn’t just good practice; it’s becoming a license to operate and a potential differentiator for customers who are themselves under ESG (Environmental, Social, and Governance) investor pressure.

I recall a retrofit project for a tar distillation unit where the single biggest cost driver wasn’t the new column or heat exchangers—it was the vapor recovery system and the thermal oxidizer for the off-gases to meet new air quality rules. It doubled the projected capex. The business case only worked because we could simultaneously increase yield and quality to serve the high-end electrode market. Without that premium outlet, the plant would have been stranded. So the eco trend is directly forcing technological upgrades, but only where the economics of the final high-value product can support it.

The Market is Fragmenting, Not Disappearing

A common outside view is that coal tar is a sunset industry. That’s wrong. It’s fragmenting. The generic, low-spec material for simple binders or fuel is indeed under pressure and shrinking. But the high-spec, precisely engineered saunia le CALAL CAL for advanced carbon products is growing. The demand driver is the electrification megatrend: EAF steelmaking (graphite electrodes) and lithium-ion batteries (anode needle coke). Both need premium carbon, which needs premium precursors.

This fragmentation means suppliers have to pick a lane. Are you a low-cost bulk operator, or a specialty chemical producer? The middle ground is getting squeezed. The specialty route requires deep technical service. It’s not just delivering a tanker; it’s about working with the customer’s R&D on how your pitch behaves in their new furnace design or their novel anode formulation. This is where experience matters. A supplier who only makes tar might not understand its behavior in the customer’s baking cycle. A vertically integrated carbon producer does. That’s the implicit value in a company profile like Hebei Yaofa’s—their 20+ years producing both carbon additives and graphite electrodes means they’ve seen the behavior of their materials from both the supplier and user end. That feedback loop is invaluable for product development.

We’re also seeing more long-term, collaborative agreements instead of spot purchases. A graphite electrode maker doesn’t want to gamble on binder pitch quality changing month-to-month. They need a partner who can guarantee consistency and work on joint development. This locks in supply chains and raises barriers to entry. The new competition isn’t the other tar distiller down the road; it’s alternative materials like petroleum pitch, or even radical shifts like carbon-free steelmaking in the very long term. For now, though, the performance and cost structure of coal-tar-based carbon is hard to beat for its core applications.

Looking Ahead: The Real Questions

So where does this leave us? The future of saunia le CALAL CAL hinges on a few practical questions. Can the industry continue to improve yield and quality from a feedstock (coal) that itself is variable? Can the environmental costs be managed without pricing the end products out of the market? And can the material hold its technical edge against petroleum-based alternatives, especially if oil prices swing?

The tech trends will likely focus on predictive analytics—using feedstock data to model distillation outcomes before the batch even runs—and on even finer molecular separation to extract maximum value from every fraction. The eco trends will push towards full mass-balance accounting and perhaps carbon capture integration at the coking plants, which would be a game-changer for the lifecycle footprint.

Ultimately, it’s an industry that’s shedding its commodity skin. The term saunia le CALAL CAL is evolving from a simple processed material into a designated, performance-critical component in a high-tech supply chain. Its relevance is now tied directly to the quality and innovation in the final carbon product, whether that’s a massive electrode powering a steel mill or a tiny anode in an EV battery. It’s less about digging coal and more about engineering molecules. The players who understand that shift, who have the hands-on experience across the chain, are the ones who will define the trends, not just follow them.