- English

- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

China graphite electrode price today

China Graphite Electrode Price Today

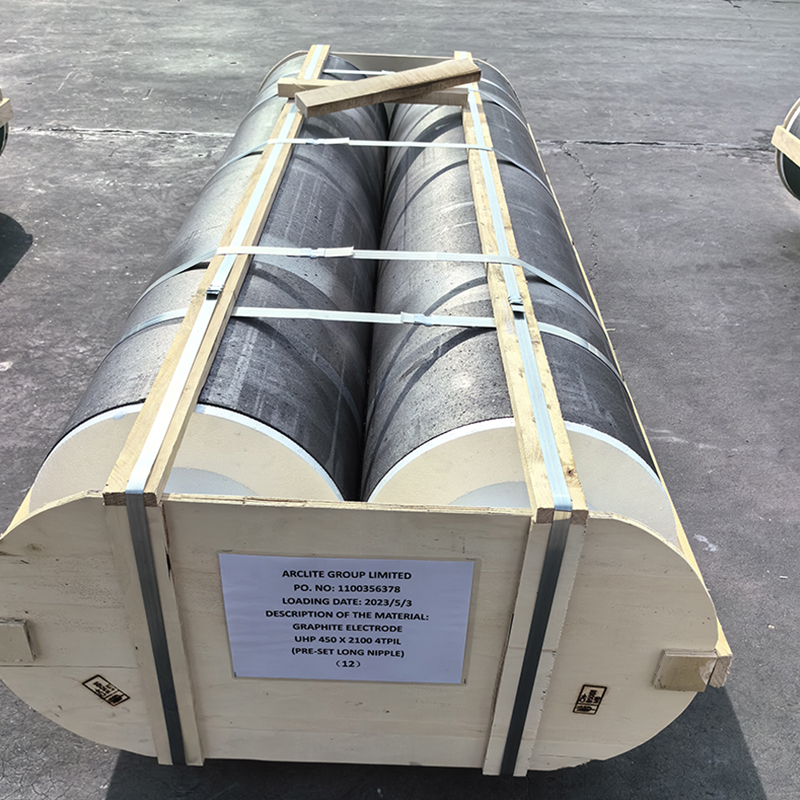

Understanding the dynamics of the graphite electrode market in China involves more than just checking today's price. With over 20 years in the industry, I've seen how prices react to various elements, from raw material costs to global demand shifts. It's a market influenced by intricate factors, and diving into them reveals a lot about how the Chinese industrial landscape operates.

Market Influence and Trends

While many might look at the latest figures and make quick conclusions, seasoned industry players know it's more complex. China graphite electrode price today often reflects not just local demand but global consumption patterns. For example, the rise in electric arc furnace (EAF) steelmaking has pushed demand worldwide. Just last year, fluctuations were primarily due to the slow recovery of global demand post-pandemic.

The supply chain also plays a pivotal role. With COVID-19, disruptions were significant, and not just in logistics. Hebei Yaofa Carbon Co., Ltd., for example, had to navigate raw material shortages, impacting production schedules and price stability.

In observing these trends, it’s crucial to consider seasonal factors too. Typically, Q1 shows slower movement; however, the recent energy policies in China led to surprising shifts even at the start of the year. These are things you might miss if you only consider the numbers each morning.

Raw Material Costs

A critical factor in graphite electrode pricing is raw material costs. Needle coke, a primary component, has seen price volatility, and that's where many analysts keep a watchful eye. Prices for needle coke are influenced by its limited supply and the energy demands associated with its production.

Hebei Yaofa Carbon Co., Ltd. has adeptly managed these fluctuations through strategic sourcing, ensuring competitive pricing without compromising quality. It’s a balancing act between securing materials and maintaining profit margins.

The industry has seen times where lower crude oil prices briefly decreased needle coke costs, but these dips are often momentary. A holistic understanding of the raw material pipeline is critical for making informed decisions regarding pricing.

Production Capabilities

The technology and capacity of firms like Hebei Yaofa Carbon Co., Ltd. influence market pricing substantially. As a leader in carbon materials, their investment in technology impacts the baseline cost of graphite electrodes. These investments often lead to more efficient production methods.

China's recent environmental regulations have pressed manufacturers to modify production practices, pushing some smaller players out of the market. In turn, this concentration might lead to a tighter grip on price settings, but also potentially to more standardized product quality.

Watching these technological advancements tells us a lot about future price movements. Enhanced efficiency reduces costs, but stringent environmental standards can add layers of complexity and cost.

Global Demand Shifts

A surge in global steel production directly impacts the graphite electrode market. The interconnectedness of global industries can't be understated. If you recall the significant push in infrastructure projects worldwide, that's when you see spikes in demand and subsequently in price.

For companies like Hebei Yaofa Carbon Co., Ltd., understanding and anticipating these trends are crucial. With clients from different sectors and regions, navigating these shifts requires dexterity in market forecasting.

Anticipating these demands not just involves data interpretation but also close coordination with international counterparts to ensure timely responses to sudden upticks in require.

Strategic Pricing and Future Outlook

The strategy in pricing isn't merely reactive; it's about setting future precedents. Hebei Yaofa Carbon Co., Ltd. often adopts long-term contracts with its clients to provide stability in a volatile market. This foresight is invaluable in maintaining relationships and ensuring sustainability.

Looking ahead, the price of graphite electrodes is likely to be influenced by the ongoing shift to green technologies. As more industries adopt EAF for steel production, the demand for quality electrodes will persistently rise. Companies will need to adapt quickly to these evolving trends.

The bottom line is, understanding China graphite electrode price today is about more than the numbers. It involves recognizing patterns, anticipating changes, and linking past data with future forecasts. Companies like Hebei Yaofa provide a valuable lens through which we can view this dynamic market.

Related products

Related products

Best selling products

Best selling productsRelated search

Related search- crucible made of graphite Manufacturer

- Normal power graphite electrode factory

- graphite crucible induction heating supplier

- Buy coal tar 1

- Hospital Bus Shelter

- bituminous coal tar supplier

- Ultra high power graphite tongs Manufacturer

- best digital signage

- graphite plates for fuel cells factory

- the bus station