- English

- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

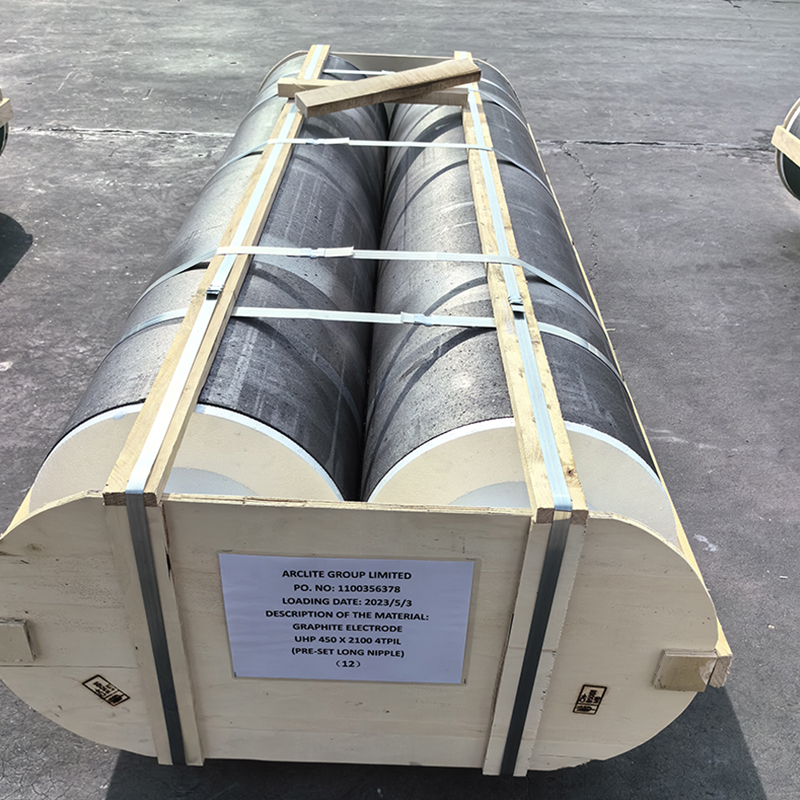

China graphite electrode spot price

Understanding the Dynamics of China Graphite Electrode Spot Price

When discussing the China graphite electrode spot price, it's easy to fall into the misconception that price trends are solely dictated by the supply-demand equation. While that's a significant factor, the reality is far more nuanced, involving everything from raw material availability to environmental policies and international trade dynamics. This complexity makes it crucial for industry insiders to continually adapt and refine their understanding.

Market Fundamentals: Supply and Demand Intricacies

Let's start by untangling some core elements. The graphite electrode market in China is a vibrant space where regional production capacities, like those seen with Hebei Yaofa Carbon Co., Ltd., play a determining role. Situated in a hub of carbon manufacturing, this company, as detailed on their website, leverages more than 20 years of expertise to produce a range of electrode grades.

Hebei Yaofa's experience highlights how production isn't just about the sheer volume of graphite electrodes but also their quality, categorized into UHP, HP, and RP grades. These categories cater to diverse industrial applications, with UHP being essential for electric arc furnaces in the steel industry—a primary driver of electrode demand.

Analyzing demand dynamics further, one must consider international influences. Chinese manufacturers often face fluctuations due to steel production rates in other leading economies. A rise in demand for steel, and consequently electrodes, can cause price shifts, frequently seen in rapid spot market changes.

Environmental Regulations: A Double-Edged Sword

Another critical aspect impacting the China graphite electrode spot price is governmental environmental policies. Over recent years, China has taken a firm stance on industrial pollution, affecting numerous sectors, including carbon manufacturing.

Such policies often result in factory shutdowns or production cuts. Hebei Yaofa and peers face these challenges head-on, maneuvering to maintain production without compromising on environmental standards. This balancing act of reducing emissions while keeping up with demand can significantly influence spot prices.

In practical terms, each regulatory wave is akin to a stock market shock, swiftly changing supply-side metrics and consequently leading to price hikes or competitive adjustments. The ability to predict these shifts, drawing from past patterns and policy announcements, becomes invaluable for market participants.

Raw Material Constraints and Pricing

Raw material accessibility is another layer affecting spot prices. Graphite electrodes are primarily derived from needle coke, a commodity itself impacted by oil price volatility. Events that affect global oil markets can trickle down, altering the cost structures for electrode manufacturers like Hebei Yaofa Carbon Co., Ltd.

For instance, a surge in oil prices can lead to increased needle coke costs, necessitating adjustments in electrode pricing. Companies, having deep industrial roots as Yaofa does, can at times absorb these costs or offset them through optimized production processes.

However, this absorption isn't always feasible, especially when compounded by other factors like export duties or anti-dumping measures from abroad. Thus, the spot prices often reflect these multi-pronged influences rather spectacularly.

Technological Advancements and Industry Shifts

Technological evolution within the graphite electrode production paradigm cannot be ignored. Advances in manufacturing technology often yield productivity gains, impacting electrode pricing. Hebei Yaofa's continuous improvement in production technology exemplifies how such advancements can play a cost-containment role.

Moreover, the industry is witnessing shifts towards more sustainable production practices. Innovations in reducing energy consumption during electrode creation not only mitigate environmental impact but also often translate to lower operational costs.

This drive towards efficiency is a trend worth monitoring. As firms adopt these innovations, they might enjoy competitive advantages, potentially reshaping price structures and contributing to a longer-term stabilization of the China graphite electrode spot price.

Future Trends and Industry Adaptation

Looking forward, the interplay of local regulations, global trade scenarios, and technological advancements will continuously mold the graphite electrode landscape. Companies like Hebei Yaofa Carbon Co., Ltd. will play pivotal roles, navigating these complexities to meet domestic and international demand efficiently.

In conclusion, grasping the nuances of the China graphite electrode spot price involves recognizing the sophisticated backdrop of production, environmental regulation, and technological progression. Such insights are not merely academic but serve as practical guides for stakeholders striving to thrive in this dynamic market.

Ultimately, those equipped with the most comprehensive understanding and adaptive capabilities will likely lead the charge in redefining the industry's future trajectories.

Related products

Related products