- English

- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

graphite electrode price 2022 supplier

Graphite Electrode Price Trends in 2022: Insights from the Field

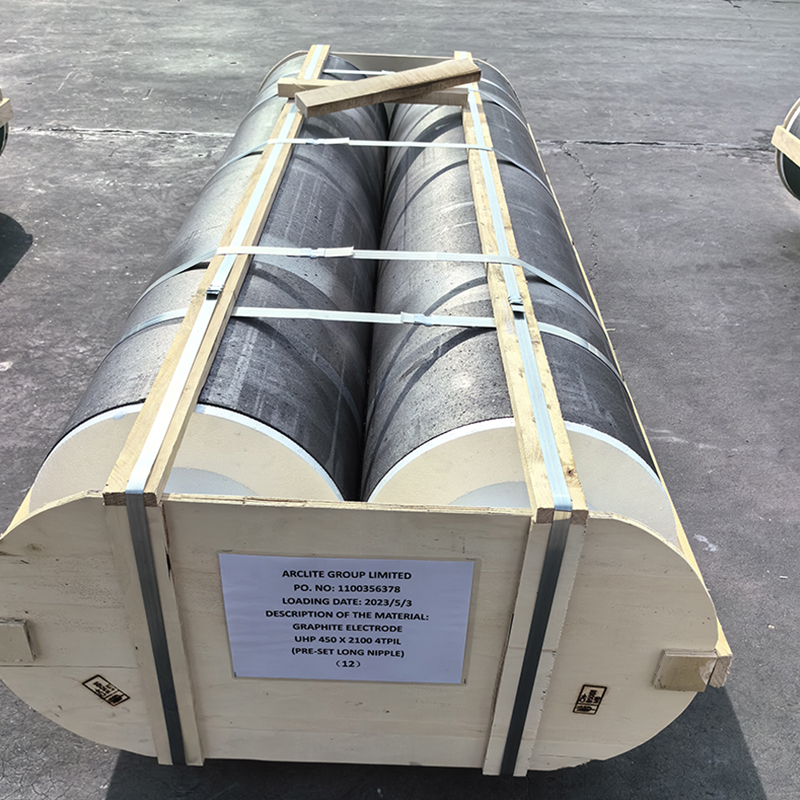

In the unpredictable world of industrial supplies, few products capture the attention of insiders quite like graphite electrodes. These essential components in electric arc furnaces have been subject to volatile pricing, particularly throughout 2022. For those new to the scene, understanding how suppliers operate, especially during tumultuous times, can be both mystifying and enlightening. Let’s dive into the intricacies of these trends, with a nod to key suppliers like Hebei Yaofa Carbon Co., Ltd.

Understanding Price Fluctuations

The price of graphite electrodes in 2022 saw a mixture of ups and downs, reflecting broader market dynamics. Various factors, such as raw material costs and geopolitical tensions, played significant roles. From experience, when the price of needle coke—essential for electrode production—fluctuates, it directly impacts cost outcomes. Suppliers need to respond swiftly to these changes to remain competitive.

Hebei Yaofa Carbon Co., Ltd., with its established place in the market, successfully navigated these variations. Having over 20 years of production insight, this company leveraged its expertise to adjust costs without compromising quality. It was impressive, considering the broader challenges faced by the industry—especially those without such seasoned experience.

An often overlooked aspect is the regional differences in pricing strategies. As someone who's dealt with suppliers globally, I’ve seen how transport logistics, local regulations, and import tariffs can cause price disparities. Companies like Hebei Yaofa have shown adeptness at managing these variables to ensure steady supply and pricing.

Supplier Strategies in Response

Suppliers, particularly experienced ones, devised strategies to remain resilient. For Hebei Yaofa Carbon Co., Ltd., this meant optimizing their supply chain to reduce costs without affecting the quality. Their approach to procurement and inventory management became a benchmark for adapting to price trends.

Interestingly, supplier flexibility became a valuable asset. Not just in terms of pricing but also in production and delivery. Investment in technology to forecast demand more accurately allowed some firms to adjust production schedules effectively.

Over time, collaboration between manufacturers and clients fostered a deeper understanding of mutual constraints. Dialogues between parties helped mitigate price impacts, which is something Hebei Yaofa has managed effectively through its transparent communication channels.

Lessons from Past Failures

While there were success stories, failures also provided lessons. On a project we handled, assuming static pricing was a costly mistake. Expecting stability in an inherently volatile market led to unfortunate budgeting issues. It's critical to build contracts that factor in potential future fluctuations.

Companies must also avoid underestimating external influences. Political shifts and trade policies affected many suppliers. In particular, those who didn’t build contingency plans struggled, leaving them vulnerable when prices soared unexpectedly.

Reflecting on these missteps, a strategy of diversification emerged as a prudent plan. Engaging with multiple suppliers, such as Hebei Yaofa, can spread risk and offer pricing alternatives, ultimately leading to better stability across the supply chain.

Technological Advancements and Their Role

As technology advanced, so has the capability to predict market trends. Utilizing AI and machine learning tools for price forecasting became more common. Suppliers like Hebei Yaofa who embraced such technology gained a competitive edge in anticipating market changes.

Furthermore, digital platforms enhanced transparency. Clients could better understand cost composition, leading to more informed negotiation talks. Suppliers transparent about their pricing breakdown, without revealing trade secrets, often found clients more cooperative when prices needed adjustments.

Implementing such technologies also improved inventory tracking and demand forecasting, thus reducing waste and optimizing resources. In a way, technology not only helped price stabilizations but also paved the path for sustainable practices in the industry.

Looking Forward: The Road Ahead

Moving into 2023 and beyond, attention shifts towards sustainability and efficiency. Suppliers are likely to focus on eco-friendly production methods and efficient resource use. Hebei Yaofa Carbon Co., Ltd., for instance, might explore green initiatives that align with market expectations for carbon footprint reduction.

Investing in research and development remains crucial. With the global emphasis on sustainability, innovative manufacturing processes will attract both clientele and investors interested in eco-conscious practices.

In summary, the graphite electrode price journey of 2022 offered valuable lessons. While the challenges were numerous, they spurred adaptations that have strengthened the industry. As we advance, those equipped with knowledge and agility, like Hebei Yaofa, will not only survive but thrive in an ever-evolving market landscape.

Related products

Related products