- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

Buy price of graphite electrode

Understanding the Buy Price of Graphite Electrode

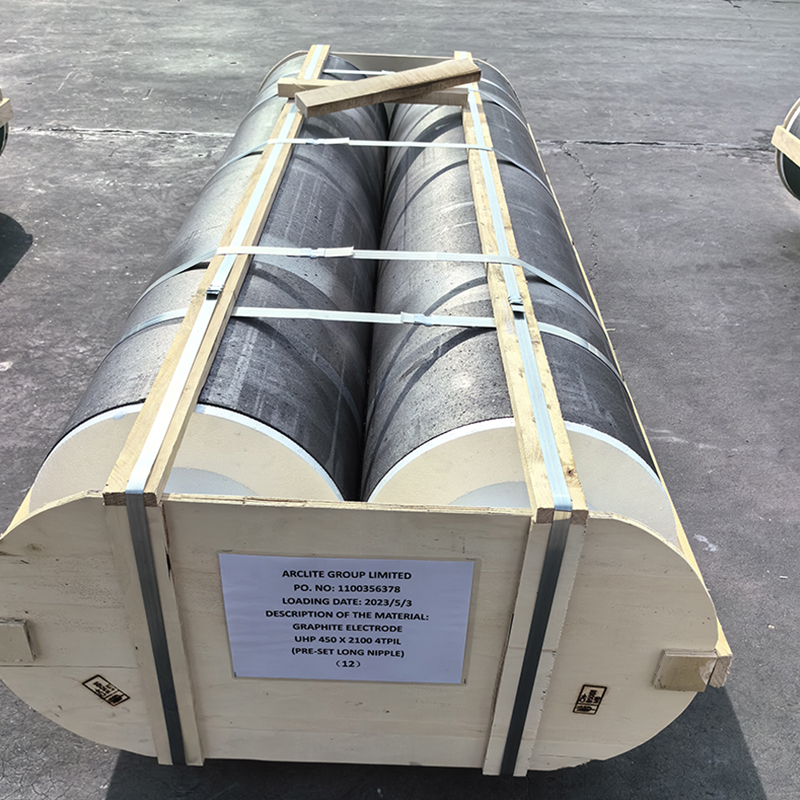

The term 'buy price of graphite electrode' might sound straightforward, yet it's a concept layered with complexity. Prices are influenced by numerous factors, and variations can be seen widely across the industry. Diving into these intricacies is essential for anyone seriously considering a purchase, as the graphite electrode is crucial in several sectors, especially metallurgy.

The Market Dynamics

The global demand for graphite electrodes, primarily due to electric arc furnace (EAF) operations, has created a dynamic market space. Fluctuations in raw material costs, the intricacies of supply chains, and geopolitical influences are all central to understanding the pricing. Factors like needle coke availability – the primary raw material – and production complexities come into play.

Over the past few years, I’ve noticed sharp contrasts in pricing across regions. Looking specifically at China, companies like Hebei Yaofa Carbon Co., Ltd. capitalize on their vast production capabilities. With more than two decades in the industry, this company exemplifies how longstanding expertise leads to competitive pricing.

Quality, of course, is another significant element. In my experience, opting for cheaper alternatives without assessing quality can jeopardize performance. Hebei Yaofa Carbon isn’t just another name; it represents industry trust, largely due to its focus on producing high-grade electrodes such as UHP/HP/RP.

Cost Components

Acquiring graphite electrodes involves understanding different cost components. Beyond the base material, processing expenses, and transportation costs play a role. A common misstep among buyers is overlooking these add-ons and facing unexpected surcharges.

The origin of raw materials significantly impacts costs. Manufacturing hubs like China often boast more competitive pricing due to resource availability and advanced production techniques. I've found it beneficial to maintain open communication with manufacturers to grasp these nuances.

Customization requests can further influence pricing. When specifying dimensions or tolerances, expect a shift in the cost. Each request equates to targeted production efforts, invariably reflecting on the final pricing.

Assessing Manufacturer Quotes

When evaluating quotes from manufacturers, it becomes clear that they’re not just numbers. They encapsulate a provider’s comprehensive offer – material quality, delivery timelines, and service assurances. Comparing quotes should be more about value than numbers alone.

Working with companies like Hebei Yaofa Carbon has taught me the importance of transparency. Their ability to detail the breakdown of costs has been invaluable in budget planning. It’s a practice more manufacturers should adopt, promoting informed client choices.

Visits to production facilities, whenever possible, allow for a first-hand assessment of operational efficiency and product inspection. This practice often aligns the perceived value with quoted amounts.

Trends and Challenges

The role of sustainability is gaining traction, pushing manufacturers towards greener practices. While this transition might nudge prices upwards, it’s an avenue worth exploring. Buyers, particularly those with environmental commitments, prioritize this trend.

Supply chain disruptions remain a constant challenge. Strategic sourcing, therefore, becomes paramount. Relying on manufacturers with robust networks mitigates risks associated with shortages and delays.

In my journey, sporadic global events have influenced material availability. For instance, during the pandemic, navigation through logistical hurdles was necessary. Hebei Yaofa Carbon’s adaptability during such times demonstrated the resilience needed in this sector.

Making Informed Decisions

Ultimately, making a purchase in this domain requires informed decision-making. Each factor, from initial quotes to understanding market trends, contributes to securing the best deal. Knowledge and experience remain your strongest allies.

Despite the competitive landscape, long-term partnerships with reliable manufacturers can open doors to preferential pricing and terms. I’ve observed this benefit often with Hebei Yaofa Carbon, as ongoing collaborations tend to foster mutual growth.

Therefore, when contemplating the buy price of graphite electrode, remember it’s more than just a transaction – it’s a strategic choice in a complex market.

Related products

Related products