China graphite electrode price 2022

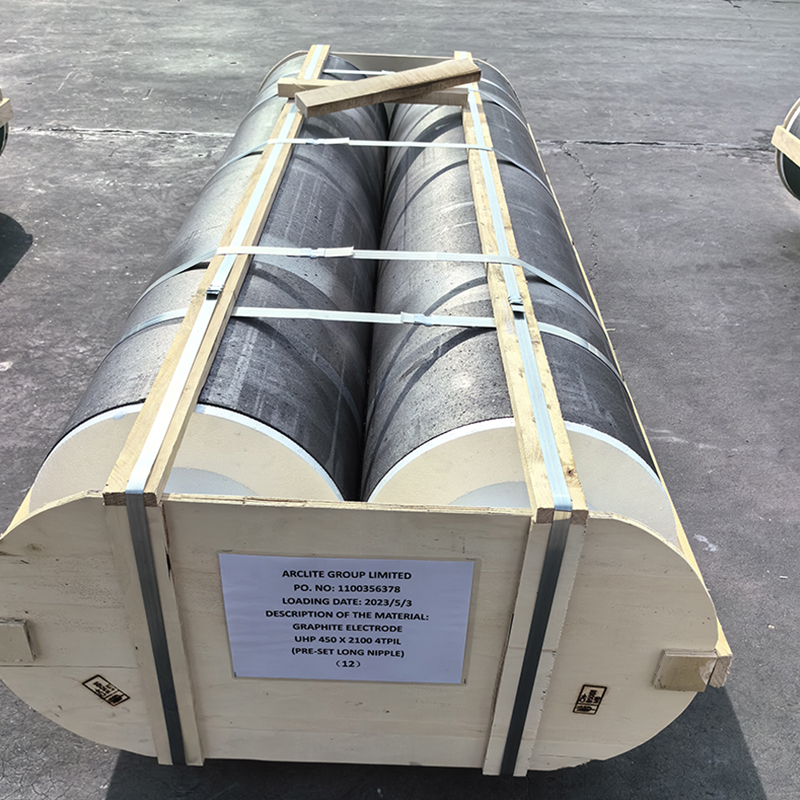

China Graphite Electrode Price 2022: A Comprehensive Market AnalysisChina graphite electrode price fluctuations in 2022 were significantly influenced by several key factors, creating a volatile market for buyers and sellers. This article provides a detailed analysis of the price trends, influencing factors, and future outlook for China graphite electrode price. Understanding these dynamics is crucial for businesses involved in the steel, aluminum, and other industries relying on graphite electrodes.

Global Graphite Electrode Market Overview

The global graphite electrode market experienced substantial changes in 2022. Demand for high-quality graphite electrodes remained strong, particularly from the steel industry in China and globally. However, supply chain disruptions, raw material price increases, and geopolitical factors significantly impacted production and pricing. This led to increased China graphite electrode price volatility throughout the year.Key Factors Affecting China Graphite Electrode Prices

Several factors played a pivotal role in shaping the China graphite electrode price in 2022. These include:- Raw Material Costs: The price of petroleum coke, a crucial raw material in graphite electrode production, fluctuated considerably throughout the year, directly impacting the final product's cost. Increases in petroleum coke prices led to corresponding increases in China graphite electrode price.

- Energy Prices: The high energy costs associated with the graphite electrode manufacturing process added further pressure to production costs and consequently to the final China graphite electrode price.

- Environmental Regulations: Stricter environmental regulations in China and other countries led to increased production costs for manufacturers, indirectly impacting prices.

- Global Demand: Strong global demand for steel and other materials requiring graphite electrodes contributed to the overall market dynamics and price fluctuations.

- Geopolitical Factors: Global geopolitical events and trade tensions also played a role in shaping the market landscape and influencing the China graphite electrode price.

Price Trends Throughout 2022

Analyzing the price trends requires accessing specific market data from reliable sources. While providing precise numerical data here is difficult without referencing specific industry reports (which are often subscription-based), we can state that overall, the China graphite electrode price experienced periods of both increase and decrease throughout 2022. These fluctuations were closely linked to the factors mentioned above.| Quarter | General Price Trend | Influencing Factors |

|---|---|---|

| Q1 2022 | Relatively Stable | Moderate demand, stable raw material costs |

| Q2 2022 | Slight Increase | Rising raw material costs, increased energy prices |

| Q3 2022 | Significant Increase | Global supply chain disruptions, high petroleum coke prices |

| Q4 2022 | Slight Decrease | Easing of supply chain issues, decreased demand |

2023 Outlook and Market Predictions

Predicting the China graphite electrode price for 2023 requires careful consideration of continuing global economic conditions, geopolitical factors, and the ongoing evolution of the graphite electrode market. While precise price projections are challenging, it's likely that price fluctuations will persist, influenced by the factors discussed previously. Companies involved in the graphite electrode industry must closely monitor market trends and adjust their strategies accordingly.For reliable, up-to-date information on graphite electrode pricing and market trends, consider consulting industry reports and market analysis firms. You can also contact manufacturers directly, such as Hebei Yaofa Carbon Co., Ltd. for insights into current market conditions and pricing.

Conclusion

The China graphite electrode price in 2022 was shaped by a complex interplay of global and local factors. Understanding these influences is crucial for navigating the market effectively. By staying informed about market trends and adapting to changing conditions, businesses can mitigate risks and optimize their operations in this dynamic market.Related products

Related products