- Chinese

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Irish

- Greek

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

- Kinyarwanda

- Tatar

- Oriya

- Turkmen

- Uyghur

electrode powder price

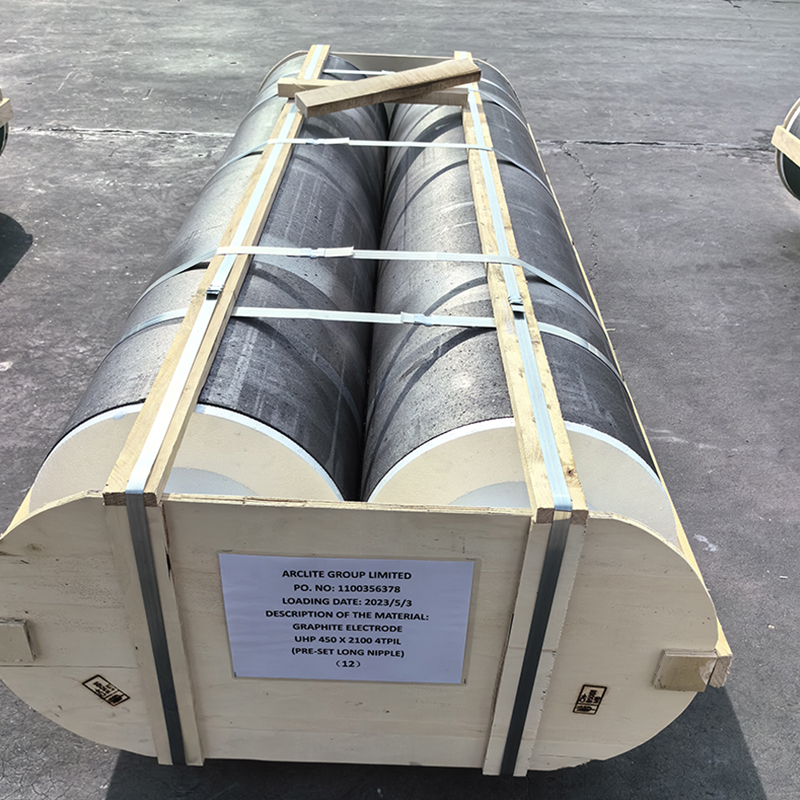

Understanding Electrode Powder Prices: Insights from the Industry

Have you ever wondered what really drives the electrode powder price? It’s not just a simple matter of supply and demand. Glean insights from industry experts and discover the underlying factors impacting costs that aren't always visible to the untrained eye.

The Basics: What Influences Electrode Powder Prices?

When we talk about the price of electrode powder, several basic economic factors come to mind: raw material costs, production techniques, and market demand. But, in the field, it's rarely that straightforward. The nuances of these elements are often overlooked. For example, graphite quality can vary, and so can the energy costs associated with production. These variations affect pricing significantly.

In my experience working with Hebei Yaofa Carbon Co., Ltd., a key player in the industry with over 20 years of experience, the quality control processes we implement have direct cost implications. Tightening these controls could directly lead to increased production costs, hence impacting the electrode powder price.

Interestingly, the geopolitical landscape also affects pricing. Trade tensions or shifts in global trade policies can disrupt material supply chains, affecting both availability and cost. These are factors companies like ours continuously monitor to stay ahead in the market.

Production Challenges and Their Financial Impact

Producing graphite electrodes and their powder involves a complex process that isn't without its challenges. At Hebei Yaofa Carbon Co., Ltd., we have encountered issues ranging from equipment breakdown to raw material shortages, each affecting our bottom line differently. When machinery underperforms, repairs or replacements are not only costly but time-consuming, leading to production slowdowns.

Energy consumption is another massive part of the cost. The furnaces required for production need substantial electricity, and fluctuations in energy prices can heavily sway the electrode powder price. We've made strides in improving efficiency, but the inherent cost remains a significant factor.

Moreover, regulatory compliance is a critical element influencing prices. Adhering to environmental regulations and implementing cleaner technologies can drive expenses higher, albeit for a worthy cause. It’s a balance between maintaining competitiveness and upholding sustainability.

Market Dynamics: Supply, Demand, and Competition

The market demand for electrode powders fluctuates based on industry needs, such as in steel and metal processing. A surge in demand often results in a price rise, yet anticipating these changes accurately is challenging. Companies must navigate these shifts delicately, often relying on forecasting models that, while useful, aren't foolproof.

Our position in the market as Hebei Yaofa Carbon Co., Ltd., detailed at our website, allows us to experience the push and pull of competition firsthand. We see how price wars can unfold when companies attempt to undercut each other, affecting profits and market stability.

Interestingly, innovation presents an intriguing dimension. As new technologies emerge, they could potentially reduce costs or open up entirely new market segments. Being adaptable and forward-thinking is crucial in leveraging these opportunities.

Supply Chain Considerations

A robust supply chain is vital in managing costs effectively. At Hebei Yaofa Carbon Co., Ltd., the strategic selection of suppliers, coupled with long-term partnerships, can mitigate risks associated with supply chain disruptions. It’s not just about securing the raw materials but ensuring their consistent quality and timely delivery.

There’ve been instances where sudden transport strikes or natural disasters have impacted supply routes, driving up costs unexpectedly. In such scenarios, having a diversified supplier base is advantageous, mitigating the impact of localized disruptions on the electrode powder price.

Logistics are another critical consideration. Efficient shipping and warehousing solutions can reduce costs significantly. Streamlining these operations is a continuous focus, reflecting directly on pricing strategies and competitive positioning.

The Future Outlook: Trends and Predictions

Looking ahead, it seems that the demand for electrode materials will continue to grow in line with industrial advancements. It’s a promising sign, but one that highlights the need for continued investment in capacity and technology.

There’s a growing interest in sustainable production methods which could redefine industry norms. Companies will likely face pressure to innovate and invest in greener technologies, a factor that could influence future pricing.

In conclusion, while the external appearance of electrode powder price might seem straightforward, it is, in reality, a complex web of factors. Real-world experiences, like those at Hebei Yaofa Carbon Co., Ltd., showcase the multifaceted nature of pricing in this industry. Keeping a finger on the pulse of market and technological trends will be key to navigating future challenges.

Related products

Related products

Best selling products

Best selling productsRelated search

Related search- graphite electrode manufacturers in world

- China Pitch tar supplier

- graphite surface plate supplier

- graphite electrodes electric arc furnace

- Buy graphite electrode price per kg

- China 2kg graphite crucible

- making a graphite crucible Manufacturer

- Graphite electrode tongs supplier

- graphite electrode manufacturer in india

- harga digital signage