graphite electrode price 2021

This article provides a detailed analysis of graphite electrode prices in 2021, examining factors influencing price fluctuations and offering insights for informed decision-making. We'll explore market trends, production costs, and the overall economic landscape that shaped the graphite electrode price during that year.

Market Trends Influencing Graphite Electrode Prices in 2021

Global Demand and Supply Dynamics

The year 2021 witnessed significant shifts in the global supply and demand for graphite electrodes. Increased steel production, particularly in emerging economies, fueled a surge in demand. Simultaneously, production challenges stemming from raw material availability and logistical bottlenecks impacted supply, leading to price volatility. Understanding these dynamics is crucial to interpreting the fluctuating graphite electrode price 2021.

Impact of Raw Material Costs

The cost of petroleum coke, a primary raw material in graphite electrode manufacturing, played a significant role in determining the final graphite electrode price. Fluctuations in petroleum coke prices, influenced by global energy markets and refinery operations, directly impacted production costs and subsequently, the market price of graphite electrodes. For example, a 10% increase in petroleum coke prices could lead to a considerable change in the final product cost.

Factors Affecting Graphite Electrode Price Volatility

Geopolitical Events and Trade Policies

Geopolitical instability and evolving international trade policies can significantly impact the availability and cost of graphite electrodes. Trade restrictions, sanctions, or disruptions to global supply chains can all contribute to price fluctuations. Therefore, staying abreast of global events is essential for predicting future price movements.

Technological Advancements and Production Efficiency

Innovations in graphite electrode manufacturing processes and the adoption of advanced technologies can influence production costs and ultimately, the market price. Increased efficiency in production can potentially lead to lower prices, while the introduction of new, more expensive technologies might have the opposite effect. Companies like Hebei Yaofa Carbon Co., Ltd. are constantly striving for efficiency improvements.

Analyzing Graphite Electrode Price Data for 2021

While precise graphite electrode price data for 2021 requires access to specialized market reports, the general trend indicated a period of volatility with prices experiencing both increases and decreases throughout the year. This volatility was largely driven by the factors discussed above. Specific price ranges would vary significantly depending on the grade, size, and supplier.

Illustrative Price Ranges (Note: These are illustrative and not precise figures):

| Electrode Type | Approximate Price Range (USD/ton) |

|---|---|

| High Power | |

| Regular Power | |

| Ultra High Power |

Disclaimer: The above price ranges are estimates and may not reflect actual market prices. For accurate pricing information, contact suppliers directly.

Conclusion

The graphite electrode price 2021 was shaped by a complex interplay of global market forces, production challenges, and geopolitical factors. Understanding these dynamics is critical for businesses involved in the steel industry and those reliant on graphite electrodes. Continuous monitoring of market trends and raw material costs remains crucial for informed decision-making in this volatile market.

Sources (Please note that specific sources for precise 2021 pricing data are proprietary and require industry subscriptions. This section would include links to relevant industry reports if available):

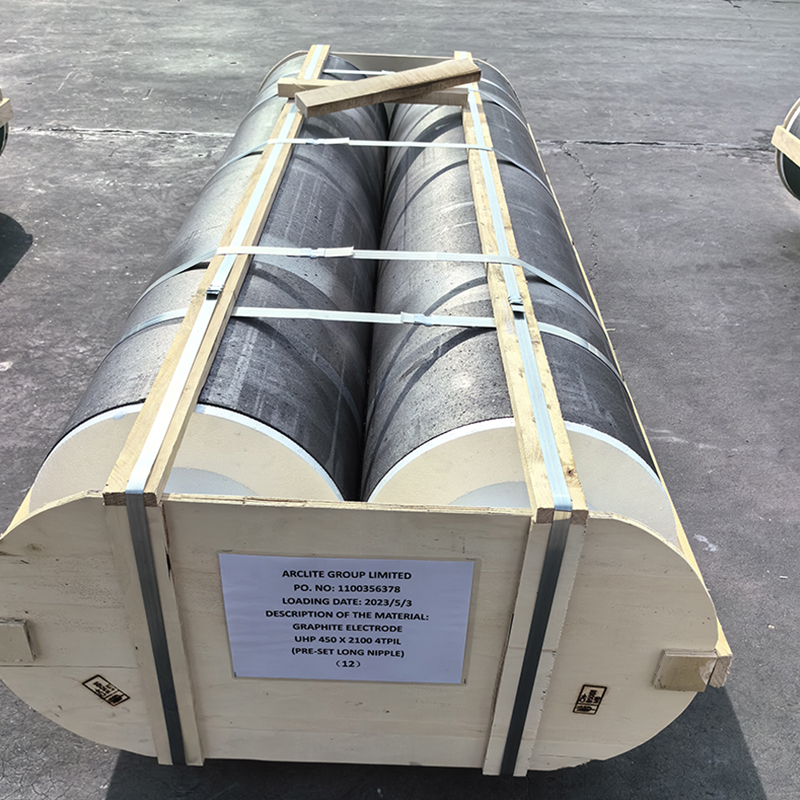

Related products

Related products