graphite electrode price 2021 factory

The year 2021 witnessed significant shifts in the graphite electrode price landscape. Several interconnected factors contributed to these fluctuations, impacting both manufacturers and consumers. This analysis delves into these influential elements to offer a clearer understanding of the market dynamics during that period. Understanding these factors is crucial for anyone involved in the steel and other industries reliant on graphite electrodes.

Raw Material Costs and Availability

Fluctuations in the prices of raw materials, primarily petroleum coke and needle coke, significantly impacted graphite electrode prices in 2021. These materials are essential components in the manufacturing process. Increased demand or supply chain disruptions directly influenced the cost of production and, consequently, the final graphite electrode price. Factors such as geopolitical events and global energy prices played a considerable role in shaping this dynamic.

Manufacturing Processes and Energy Costs

The energy-intensive nature of graphite electrode production makes it particularly sensitive to energy price fluctuations. Electricity costs account for a substantial portion of the overall manufacturing expense. Therefore, increases in electricity prices or other energy sources directly translated into higher graphite electrode prices in 2021. Furthermore, advancements and changes in manufacturing processes also played a part in influencing costs.

Market Demand and Supply

The global demand for graphite electrodes is heavily tied to the steel industry's health. In 2021, variations in global steel production, influenced by factors like economic growth rates and infrastructure projects, affected demand. A higher demand generally pushes graphite electrode prices upward, whereas a decrease in demand can lead to price reductions. Supply chain issues, including transportation costs and delays, further exacerbated price volatility.

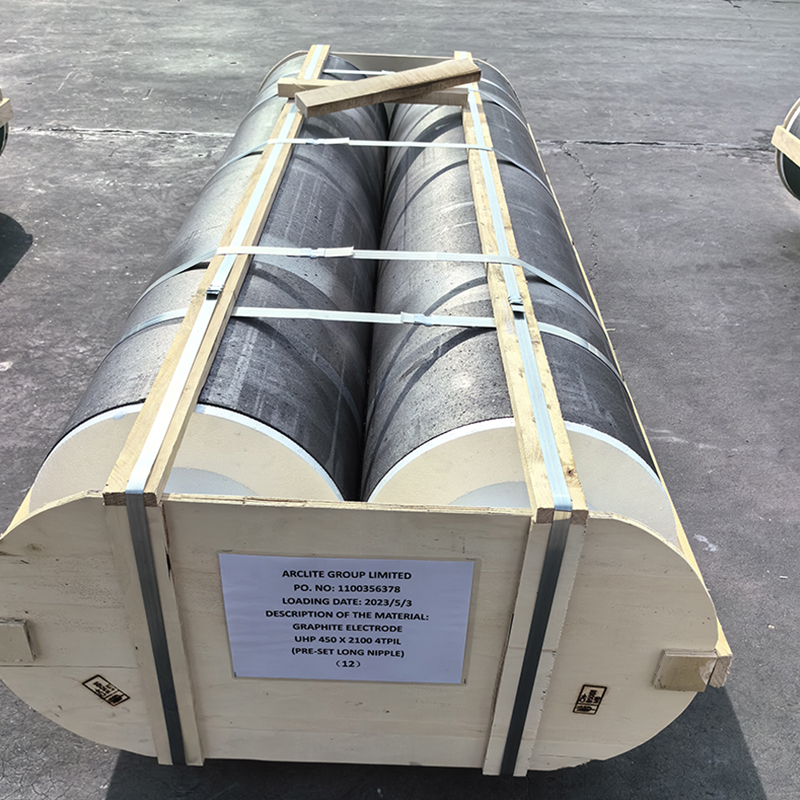

A Closer Look at Factory-Level Prices

The graphite electrode price at the factory level is influenced by all the aforementioned factors and more. Internal factory efficiencies, technological advancements, and negotiations with suppliers all play a role in determining the final cost. Specific factory locations, access to resources, and regional economic conditions also affect pricing strategy and competitiveness.

Table: Factors Influencing Graphite Electrode Prices in 2021

| Factor | Impact on Price |

|---|---|

| Raw Material Costs (Petroleum Coke, Needle Coke) | Directly proportional – higher costs lead to higher graphite electrode prices. |

| Energy Costs (Electricity) | Directly proportional – increased energy costs result in higher production expenses. |

| Global Steel Production | Demand-driven – higher steel production increases demand, potentially raising prices. |

| Supply Chain Efficiency | Indirectly proportional – disruptions lead to higher costs and potential price increases. |

For a deeper understanding of the current market trends and to explore potential collaborations, consider contacting Hebei Yaofa Carbon Co., Ltd., a leading manufacturer of high-quality graphite electrodes. Their expertise and insights can provide valuable information for navigating this dynamic market.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial or investment advice. Market conditions are constantly evolving, and actual graphite electrode prices may vary based on various factors. Always conduct thorough research and consult with relevant professionals before making any decisions.

Related products

Related products