graphite electrode price 2022

The graphite electrode price in 2022 experienced significant volatility, influenced by a complex interplay of global economic conditions, raw material availability, and energy costs. Understanding these factors is crucial for businesses relying on graphite electrodes in various applications, from steelmaking to aluminum production. This guide aims to provide a comprehensive overview of the market dynamics that shaped graphite electrode prices last year.

Factors Affecting Graphite Electrode Prices in 2022

Raw Material Costs

The cost of petroleum coke, a primary raw material in graphite electrode manufacturing, directly impacts the final price. Fluctuations in global oil prices and petroleum coke availability throughout 2022 significantly contributed to price volatility. Increased demand from other industries also played a role.

Energy Prices

The energy-intensive nature of graphite electrode production makes energy costs a major determinant of the final price. Soaring energy prices in 2022, driven by geopolitical events and increased demand, exerted considerable upward pressure on graphite electrode prices.

Global Demand and Supply

Global demand for graphite electrodes is heavily influenced by steel and aluminum production levels. Changes in construction activity, automotive manufacturing, and other industrial sectors directly affect demand and, consequently, pricing. Supply chain disruptions, including logistical challenges and factory closures, further complicated the situation throughout 2022.

Government Regulations and Policies

Environmental regulations and government policies aimed at reducing carbon emissions also played a role. Increased scrutiny of production processes and stricter environmental standards can add to manufacturing costs, impacting the final graphite electrode price.

2022 Graphite Electrode Price Trends

While precise pricing data requires accessing specialized market reports, the general trend in 2022 showed a period of initial increase followed by some stabilization towards the latter half of the year. This fluctuation mirrored the volatile nature of the factors mentioned above. Specific price ranges varied greatly depending on electrode size, quality, and supplier. For detailed and up-to-date pricing information, it's recommended to contact reputable suppliers directly, such as Hebei Yaofa Carbon Co., Ltd., a leading manufacturer of high-quality graphite electrodes.

Predicting Graphite Electrode Prices in 2023 and Beyond

Predicting future graphite electrode prices with certainty is challenging due to the inherent volatility of the market. However, analysts generally expect prices to remain relatively stable in the short term, barring unforeseen global events or significant shifts in supply and demand. Long-term projections depend on various factors, including technological advancements in manufacturing and evolving environmental regulations.

Table: Estimated Graphite Electrode Price Range (USD/kg) in 2022 (Illustrative)

| Electrode Size (mm) | Q1 2022 (Estimate) | Q2 2022 (Estimate) | Q3 2022 (Estimate) | Q4 2022 (Estimate) |

|---|---|---|---|---|

| 300 | $X | $Y | $Z | $W |

| 400 | $A | $B | $C | $D |

Note: The data presented in the table is for illustrative purposes only and should not be considered precise market pricing. Contact industry suppliers for accurate and up-to-date pricing information.

For more information on graphite electrode manufacturing and supply, please visit Hebei Yaofa Carbon Co., Ltd. website.

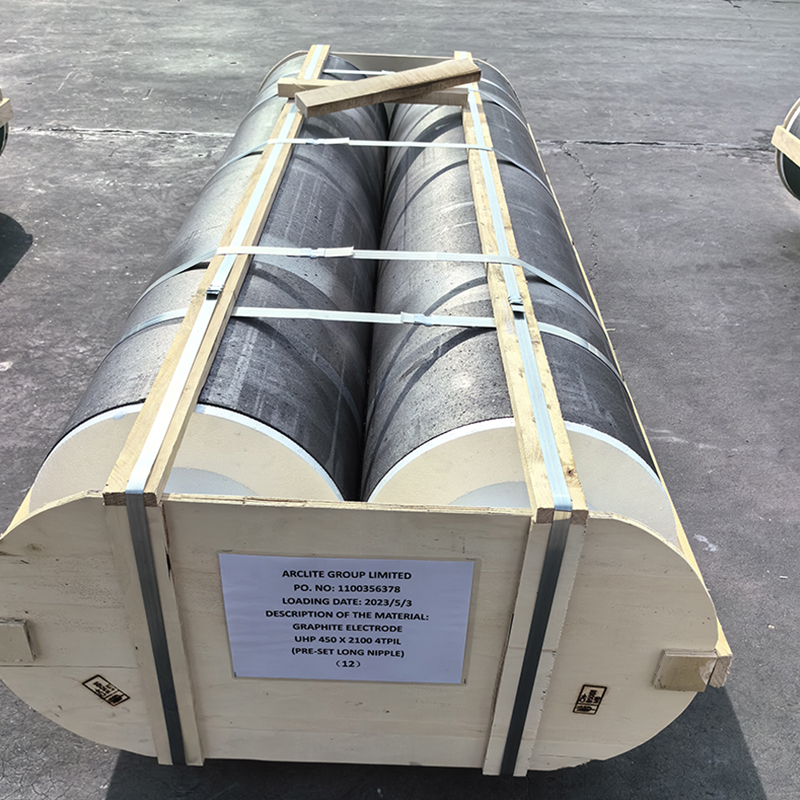

Related products

Related products